Biden = Eco-friendly & Renewable Energy vs Trump = Traditional Infrastructure like Construction, Steel, Energy, plus Space & Defense

Internet, Secondary Batteries, Pharma & Bio in Structural Growth Phase Remain of Continued Interest

"Political Volatility Increases, Short-term Burden... It's Not Too Late to Respond After Election Results"

[Asia Economy Reporter Oh Ju-yeon] The domestic stock market is busy searching for beneficiary stocks before and after the U.S. presidential election, as expectations for the stock market after the U.S. election and the negative factor of the resurgence of COVID-19 are conflicting. Since Democratic candidate Joe Biden and U.S. President Donald Trump have opposite political tendencies, their policies are also completely different, which could increase volatility by sector and stock. In addition to environment and infrastructure, contrasting views on foreign policy, regulations, and policies suggest that the fortunes of beneficiary stocks may fluctuate depending on the power struggle between the two candidates until just before the election.

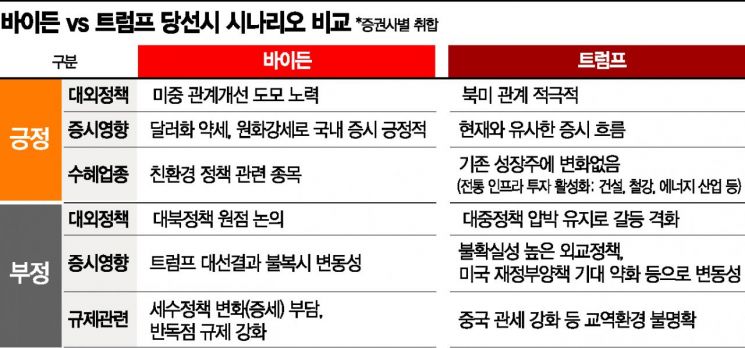

On the 23rd, Asia Economy surveyed domestic securities firms about the positive and negative factors for the stock market depending on the election outcome of Trump or Biden. In the foreign policy sector, Trump emphasizes protectionism, which could be negative for domestic export companies, while Biden pursues multilateralism, potentially benefiting export companies through revitalized trade with allies. Regarding relations with China, if Trump is elected, pressure on China is likely to continue, so the sectoral trends in the current market are not expected to change significantly. Among these, the stocks reacting first in the market are those related to Biden’s policies promoting eco-friendly and renewable energy industries.

Biden has announced plans to invest $2 trillion over four years in eco-friendly policies and to rejoin the Paris Climate Agreement, leading to strength in sectors related to clean energy infrastructure. In particular, in Korea, related stocks that surged once in September due to the government’s 'Green New Deal' policy are expected to stir again. Representative sectors include secondary batteries (LG Chem, SK Innovation, Samsung SDI, etc.), solar power (Hanwha Solutions, etc.), wind power (CS Wind, etc.), and hydrogen energy (Doosan Fuel Cell, etc.) within the renewable energy industry. The automobile sector related to electric vehicles (Hyundai Motor, etc.) and the semiconductor sector, expected to benefit from economic and trade recovery, are also forecasted to be favorable.

The pharmaceutical sector is also considered a major beneficiary. Biden’s health insurance policy focuses on complementing and expanding former President Barack Obama’s Affordable Care Act (Obamacare), which could strengthen pharmaceuticals and healthcare. However, the internet sector may experience increased volatility whenever regulatory issues concerning IT and platform companies arise.

If Trump is re-elected, the burden of IT company regulations would ease, making the internet sector a priority beneficiary, opposite to Biden’s case. Unlike the scenario with Biden’s election, the semiconductor sector could attract attention as it might gain indirect benefits from conflicts with China in the IT industry. While the renewable energy industry may be sidelined, sectors such as traditional infrastructure (construction, steel, energy industries, etc.) are expected to be viewed positively as Trump has announced plans to invest in these areas and ease regulations. Trump is also promoting COVID-19 vaccine development within the year and a return to normal life next year, so economically sensitive stocks could respond quickly.

Despite the contrasting policies of the two candidates, there are sectors expected to benefit regardless of who wins. Daishin Securities stated that although sector preferences may change depending on the election result, sectors expected to experience structural growth due to global policy, social, and cultural changes after COVID-19 (internet, secondary batteries, pharmaceuticals and bio) and representative export sectors benefiting from global economic recovery and policy momentum (semiconductors, automobiles) should be continuously monitored regardless of the winner. SK Securities identified 5G as a common beneficiary. Both candidates’ policy pledges include the 'policy to enable ultra-high-speed internet broadband access across the U.S.' Although Trump’s policy places more emphasis on this, Biden also promotes increased investment in research and development of innovative technologies such as electric vehicles, lightweight materials, 5G, and artificial intelligence (AI), indicating that both candidates share similar views on digital infrastructure development.

However, in the short term, any sector could be exposed to volatility amid heightened political uncertainty, so there is no need to rush. Seo Sang-young, head of the investment strategy team at Kiwoom Securities, said, "While the election of Trump or Biden is important, the congressional power structure is an even more crucial election," adding, "In the short term, no sector is easy, so dividend-heavy bank stocks or defensive stocks are expected to perform better than the market average."

Choi Seok-won, head of the research center at SK Securities, also said, "Considering the rise in renewable energy sectors, the market is highly anticipating Biden’s victory, but given the U.S. election system, uncertainty remains," and added, "It is necessary to be cautious about blindly investing in one direction, and it may be advantageous from an investment perspective to respond after seeing the election results."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.