Historic Worst Decline in Maritime Cargo Volume Due to COVID-19

Shipbuilders' Stock Prices Plunge Amid Past Cargo Volume Declines

Qatar Windfall Merely Temporary Boost to Stock Prices

[Asia Economy Reporter Minji Lee] There is a forecast that the corporate value of the shipbuilding industry in the fourth quarter will deteriorate further as the second half progresses. This is because maritime cargo volume has plummeted to an all-time low due to the spread of the novel coronavirus disease (COVID-19), and shipowners' order volumes are almost nonexistent.

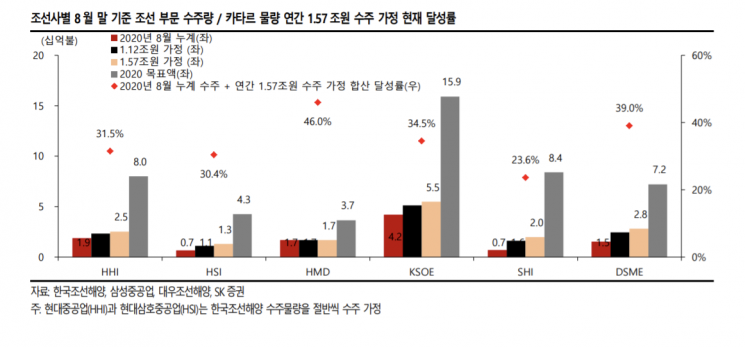

According to SK Securities on the 27th, the cumulative ship orders as of August amounted to only 8.12 million CGT. Assuming the current trend of order volumes continues, it is projected that this year's order volume will decrease by 57% compared to the same period last year.

▲A domestic shipbuilding company delivered the world's first natural gas-powered LNG carrier last year (photo unrelated to the article content)

▲A domestic shipbuilding company delivered the world's first natural gas-powered LNG carrier last year (photo unrelated to the article content)

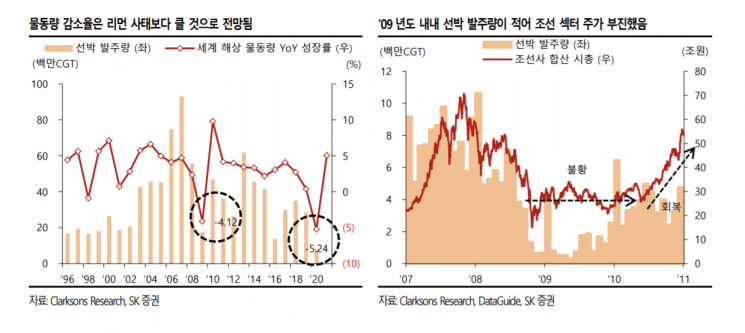

Looking back at the Lehman Brothers crisis, the maritime cargo volume in 2009 recorded 8.265 billion tons, down 4.12% from the previous year (8.62 billion tons), as the long-term recession phase persisted. Even before Lehman Brothers filed for bankruptcy protection on September 15, 2008, shipowners' order volumes sharply declined amid growing concerns over financial tightening. In 2009, ship orders fell by 68% compared to the same period the previous year, totaling only 17.56 million CGT. The stock prices of domestic shipbuilders, which ranked first in the global shipbuilding industry, also underwent significant adjustments.

Seungwoo Yoo, a researcher at SK Securities, explained, "It took quite a long time for stock prices and maritime cargo volumes to recover from the decline at that time. Cargo volumes only began to recover around 2010, and shipbuilders' stock prices started to recover in earnest from 2019."

Since it is uncertain when the recession caused by COVID-19 will recover, it is expected that it will take a long time for maritime cargo volumes to rebound as well. Currently, Clarkson Research forecasts that this year's maritime cargo volume will be 11.24 billion tons, a 5.24% decrease compared to last year's 11.86 billion tons. Researcher Yoo analyzed, "It is expected to experience the largest decline since records began, and given the significant drop, the recession could last even longer than the Lehman Brothers crisis."

The outlook for the shipbuilding industry in the fourth quarter is also negative. Corporate values are expected to worsen as the second half progresses. Looking at the monthly new ship price trends up to August, new ship prices, mainly for VLCCs and bulk carriers, have been rapidly declining since April. Although bulk carriers are not a ship type ordered by domestic shipbuilders and can be excluded, the sharp decline in VLCC prices is negative. Container ships have also recorded a slight downward trend since April, with only LNG carriers holding steady.

Researcher Yoo said, "Over the past two years, the industry has been sustained by the advances of Korea Shipbuilding & Offshore Engineering and Samsung Heavy Industries, but there is no sign of an increase in the combined order backlog of the three companies including Daewoo Shipbuilding & Marine Engineering. Thanks to Korea Shipbuilding & Offshore Engineering and Samsung Heavy Industries securing some LNG carrier and VLCC orders, new ship prices managed to hold up in 2019, but if cargo volumes decline, the downward trend in new ship prices will be unavoidable."

The Qatar LNG carrier orders are not an immediate positive factor for the three domestic shipbuilders. Since these are slow reservations and not confirmed orders, the actual order volume may change. As of the end of last year, cumulative shipbuilding orders for each company were $4.2 billion for Korea Shipbuilding & Offshore Engineering, $700 million for Samsung Heavy Industries, and $1.53 billion for Daewoo Shipbuilding & Marine Engineering, indicating a sluggish situation. Even when combined with Qatar orders, the achievement rates against this year's order targets are 34.5%, 23.6%, and 39%, respectively. Researcher Yoo stated, "The Qatar factor only led to a temporary stock price increase. Since a recession in the second half is inevitable, it should be seen as a warning sign for achieving the annual order targets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.