Shinhan Financial Investment Report

Advice to Buy Kiwoom Securities by Korea Financial Group

[Asia Economy Reporter Minji Lee] As liquidity continues to flow into the stock market, there are expectations that securities stocks could enjoy additional benefits.

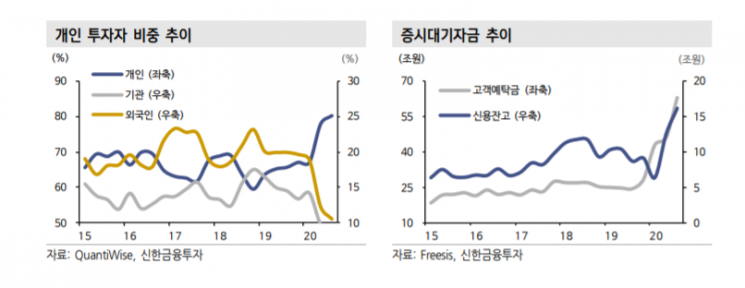

According to Shinhan Financial Investment on the 13th, the average daily trading value in the third quarter was 27.7 trillion KRW based on the previous day's cumulative data, marking a 27% increase compared to the previous quarter. Monthly figures show 23.9 trillion KRW in July, 31 trillion KRW in August, and 31.7 trillion KRW in September. Based on the cumulative average by investor type in QTD, individuals accounted for 80.2%, foreigners 10.6%, and institutions 9.2%.

As of the previous day, customer deposits stood at 57 trillion KRW. On August 31, customer deposits surpassed 60 trillion KRW for the first time in stock market history. After that, it sharply dropped to 48 trillion KRW on September 2, then recovered to 63 trillion KRW on September 4. Researcher Heeyeon Lim of Shinhan Financial Investment explained, “This was due to a large inflow of funds for the Kakao Games subscription from September 1 to 2, influenced by the recent public offering craze.”

Although the margin deposits of 58.2 trillion KRW, which exceeded the public offering amount (3.854 trillion KRW), were refunded, approximately 29 trillion KRW is estimated to remain in the stock market in the form of customer deposits (16 trillion KRW) and CMA (13 trillion KRW). Researcher Lim said, “These funds will be reused for upcoming IPO subscriptions,” adding, “Following Big Hit, KakaoBank is also scheduled for subscription next year.”

Trading value is expected to maintain its current level in the second half of the year. Rather than sharply declining, it is more likely to sustain the current level. Considering real estate policies, stock market tax reforms, and the establishment of New Deal funds, it is judged that the government intends to channel liquidity into the stock market. Researcher Lim analyzed, “The current level of trading value will be maintained,” and “Considering public offering subscriptions, individual investors are voluntarily showing interest in the stock market at this time.”

Among securities stocks, positive outlooks were given for Korea Financial Group and Kiwoom Securities. Korea Financial Group is expected to benefit from the listing of KakaoBank. As the second-largest shareholder holding 33.35% of KakaoBank’s shares, additional price appreciation is anticipated if the share value is reflected in the stock price.

Kiwoom Securities is expected to benefit from increased stock trading. Profit recovery in the trading division due to the stock market rebound and improved commissions from increased trading value are anticipated. Researcher Heeyeon Lim stated, “In the current stock market, a strategy to increase weighting in securities stocks is effective, and all securities stocks benefit,” adding, “When trading value increases, you must definitely hold them.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.