Support to Overcome the COVID-19 Crisis through the 3rd Supplementary Budget

[Asia Economy Reporter Kim Daeseop] The Ministry of SMEs and Startups announced on the 16th that it will supply liquidity funds worth 2.1 trillion KRW to the market through the 3rd supplementary budget to overcome the novel coronavirus infection (COVID-19) crisis and firmly prepare for the post-COVID era.

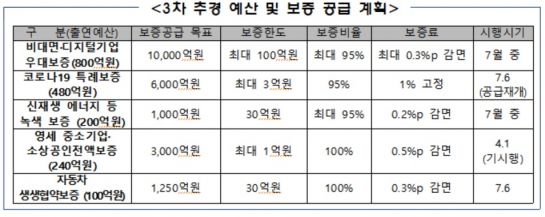

The Ministry of SMEs and Startups and the Korea Technology Finance Corporation will establish a new "Non-face-to-face and Digital Enterprise Preferential Guarantee" worth 1 trillion KRW (maximum guarantee ratio of 95%, guarantee fee rate reduced by up to 0.3 percentage points). The main support targets are non-face-to-face companies and digital companies possessing technologies related to the 4th Industrial Revolution, such as data, networks, artificial intelligence, and information and communication technology.

The guarantee limit is up to 10 billion KRW, including facility funds. They plan to execute liquidity funds swiftly through relaxed approval authority and non-visit agreements.

An additional 600 billion KRW of COVID-19 special guarantees will also be supplied. Considering the continuous increase in demand for special guarantees due to the prolonged COVID-19 situation, this is supplied additionally beyond the 905 billion KRW COVID-19 special guarantees exhausted in June last year.

The COVID-19 special guarantee application targets are companies affected by COVID-19 and related goods manufacturing and service companies. If the COVID-19 damage is proven, support of up to 300 million KRW can be received regardless of existing guarantees. The guarantee ratio (95%) and guarantee fee (fixed at 1.0%) are also preferentially applied to reduce the burden on affected companies.

Considering the urgency of the situation, such as the full-scale impact of COVID-19 on micro small business owners, "Full Guarantee for Micro SMEs and Small Business Owners" will continue to be supplied at a scale of 300 billion KRW.

In line with the government's Green New Deal policy, a "Green Guarantee" will also be newly established to support renewable energy technology companies. The support targets are companies engaged in renewable energy power generation businesses or companies producing renewable energy industry items. A total of 100 billion KRW in liquidity (up to 95% preferential guarantee, guarantee fee rate preferentially reduced by 0.2 percentage points or more) will be supplied.

The Green Guarantee supports operating and facility funds for renewable energy technology development and commercialization by utilizing climate environment technology evaluation models and carbon value evaluation models.

Additionally, a "Coexistence Guarantee for the Automobile Industry" worth 125 billion KRW has been prepared. It offers preferential support such as 100% full guarantee and a guarantee fee rate reduction of 0.3 percentage points. Besides large company partners, general companies engaged in the automobile parts industry are also included as support targets, focusing on supplying working capital for business stabilization across the entire automobile parts industry.

Lee Okhyung, Head of the Venture Innovation Policy Division at the Ministry of SMEs and Startups, said, "Through this 3rd supplementary budget, we plan to do our best to swiftly supply liquidity to overcome the COVID-19 crisis, and to ensure that policy outcomes of key projects such as guarantees for non-face-to-face and digital companies preparing for the post-COVID era and the Green Guarantee, one of the main support tools of the Green New Deal, appear quickly."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.