Government Announces 'Materials, Parts, and Equipment 2.0' Strategy

Expansion of Supply Management Items, 5 Trillion Won Investment in Technology Development

Domestic Return Agreements... Uncertain if Overseas Projects Will Return

Reluctant Support for Capital Region U-Turns... Questions on Effectiveness

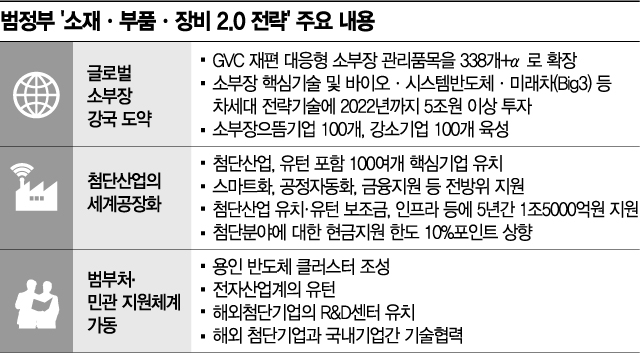

[Asia Economy Reporter Moon Chaeseok] The 'Materials, Parts, and Equipment (MPE) 2.0 Strategy' announced by the government on the 9th aims to shift from a defensive stance against Japan's export restrictions to proactively responding to the reorganization of the Global Value Chain (GVC) and attracting advanced industries. On the same day, President Moon Jae-in personally visited semiconductor company SK Hynix to reinforce policies aimed at becoming a strong nation in MPE. The government plans to advance the MPE industry through the establishment of advanced investment zones and technology development investments exceeding 5 trillion won. However, there are criticisms that these measures are insufficient to expand reshoring (returning operations to Korea) and attract foreign investment. Experts emphasize the need for bold support measures along with a revolutionary improvement in the domestic business environment.

◆Agreement on Domestic Return of Large Corporations and Partners...Lacks Specificity= At the event, agreements were made on ▲ SK Hynix investing 120 trillion won to build four semiconductor factories and create a semiconductor cluster gathering about 50 MPE companies ▲ the formation of a 'Return Activation Council' among demand large corporations in the electronics industry such as Samsung and LG Electronics, partner companies, and support organizations like KOTRA ▲ establishment of 'Yumicoa R&D Center,' Asia's largest secondary battery cathode material R&D center in the foreign investment zone of Cheonan, Chungnam ▲ and expansion of domestic supply through agreements between global semiconductor companies like Lam Research and Texon and six domestic MPE companies.

However, it remains uncertain whether the agreement ceremony for domestic return between large corporations and partner companies will actually lead to reshoring of overseas operations. Among these, the policy related to large corporation reshoring is the Return Activation Council among demand large corporations in the electronics industry, partner companies, and support organizations, but realistically, it seems difficult to induce domestic return from demand large corporations such as Samsung and LG. An official from the Ministry of Trade, Industry and Energy explained, "In principle, the council is to hold meetings once every quarter," adding, "Samsung, LG, Winia Daewoo, and other demand companies have not specifically committed to reshoring." Professor Jeong In-gyo of Inha University's Department of International Trade stated, "Rather than forcibly trying to significantly increase the number of reshoring companies, it is more realistic to implement policies that advance the MPE industry into high-tech industries to increase added value."

◆Establishment of Advanced Investment Zones...Will Foreign Investment Increase? On the same day, the government also announced policies to designate some existing planned sites such as industrial complexes and MPE specialized complexes as advanced investment zones, focusing on investment demand for 158 items classified as 'advanced type' among 338 supply management items, and provide support such as land use regulation exemptions, burden fee reductions, and priority review in regulatory free zones.

Experts say that if investment zones are concentrated mainly in the Seoul metropolitan area, which is an ICT cluster, it will help attract investment including foreign direct investment (FDI). National research institutes like the Korea Institute for International Economic Policy and academia have suggested that high value-added industries should be induced to return from China and Japan to Korea through nearshoring (dispersing production lines to neighboring countries), and for such companies, investment zones should be developed mainly around the Seoul metropolitan area. Professor Kang In-soo of Sookmyung Women's University said, "It seems desirable that the government decided to designate some existing planned sites rather than creating another industrial complex to revitalize the MPE industry," but added, "The effectiveness of the MPE 2.0 strategy will increase if investment zones are concentrated near industrial complexes in the metropolitan area and regulatory relaxations for 158 items are actively implemented."

◆Support for Seoul Metropolitan Area Reshoring is Rehash= The support amount for site, facility, and relocation costs for reshoring companies in the Seoul metropolitan area presented in the MPE 2.0 strategy is up to 15 billion won per company. This applies only to advanced industry sectors such as semiconductors, bio, and future cars. This is exactly the same as the 'Second Half Economic Policy Direction' announced by the government last month. However, support for non-metropolitan reshoring companies will increase from 20 billion won to 30 billion won.

Considering that the core of the MPE 2.0 strategy is 'high value-added transformation into advanced industries,' there are criticisms that regulations in the Seoul metropolitan area, where advanced companies such as semiconductors, bio, and future cars are concentrated, should have been relaxed more boldly. Professor Kang said, "A GVC reorganization policy should have been presented to actively attract platform operators enough to create a second Pangyo Techno Valley," adding, "Although 15 billion won support per business is not a small amount, it is not enough to make financially weak small companies or platform companies seriously consider reshoring."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.