Real Estate 114 Survey: Slower Price Increase in Reconstruction with Strengthened Resident Requirements for Association Members

[Asia Economy Reporter Yuri Kim] Unlike past measures that initially cooled the market upon announcement, the recent June 17 measures have yet to exert significant influence on the real estate market. The December 16 measures last year sharply slowed the rise in Seoul's sale prices immediately after their announcement and led to a weak market from March to May this year. In contrast, the June 17 measures, which include a significant expansion of regulated areas and restrictions on gap investments, have seen sale price increases maintained even immediately after their announcement. Since regulatory actions began in earnest from July, some time is needed to verify their effects, but discussions on additional government measures have already started due to balloon effects toward non-regulated areas.

According to Real Estate 114 on the 3rd, the weekly apartment sale price change rate in Seoul remained the same as the previous week at 0.12%. General apartments rose by 0.13%, maintaining a similar rate of change, but reconstruction apartments saw a significant decrease in the rise rate to 0.06% from last week's 0.15%. Additionally, Gyeonggi and Incheon rose by 0.10%, and new towns increased by 0.06%, continuing the upward trend.

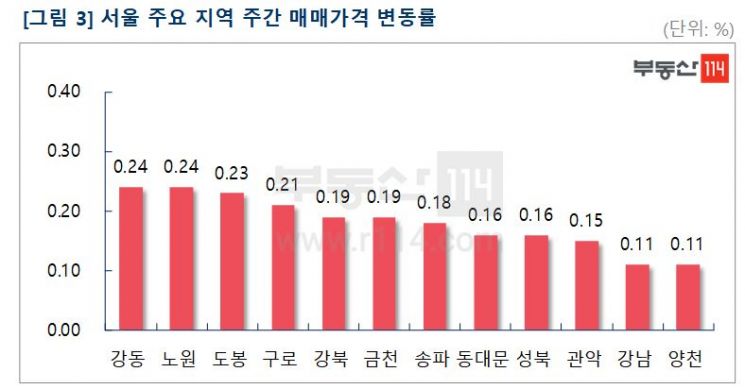

In Seoul, the districts rose in the following order: Gangdong (0.24%), Nowon (0.24%), Dobong (0.23%), Guro (0.21%), Gangbuk (0.19%), Geumcheon (0.19%), Songpa (0.18%), Dongdaemun (0.16%), and Seongbuk (0.16%). Following the June 17 measures and various regulations, homeowners are showing reluctance to engage in transactions. Particularly in Gangdong, after the rapid sale of urgent listings, no additional listings have appeared, deepening the shortage of available properties. Raemian Myeongil Station Solvenue in Myeongil-dong rose by 25 million KRW, and Dunchon Prugio in Dunchon-dong and Gangdong Ja-i in Gildong rose by 5 to 25 million KRW.

In Nowon, short-term demand concentrated to avoid regulations exhausted the mid-to-low price listings on the market. Sangye Jugong 7 Complex in Sangye-dong rose by 5 to 15 million KRW, and Gongneung 8 and 9 Complex Cheongsol in Gongneung-dong rose by 5 to 25 million KRW. Dobong saw rises of 5 to 10 million KRW in Changdong Jugong 3 Complex and Dongik Park in Ssangmun-dong. In Guro, Guro Hyundai in Guro-dong rose by 10 to 15 million KRW, and Daerim 2nd Complex in Sindorim-dong rose by 2.5 to 12.5 million KRW.

New towns rose in the following order: Ilsan (0.09%), Dongtan (0.08%), Bundang (0.07%), Pyeongchon (0.07%), Sanbon (0.07%), Gimpo Hangang (0.07%), and Paju Unjeong (0.06%). In Ilsan, demand to avoid regulations led to the exhaustion of low-priced urgent listings. Baeksong 5 Complex Samho Poonglim in Baekseok-dong, Munchon 2 Complex Life in Juyop-dong, and Hugok 4 Complex Kumho and Hanyang in Ilsandong rose by 5 million KRW. In Dongtan, Dongtan 2 I-Park in Jangji-dong, Dongtan Pureunmaeul Shinil Happy Tree in Neung-dong, and Bando Yubora Ivy Park 3.0 in Osan-dong rose by 2.5 to 10 million KRW. Bundang saw rises of 5 to 10 million KRW in Jangmi Hyundai in Yatap-dong, Hansol LG in Jeongja-dong, and Mujigae 1 Complex Daerim in Gumi-dong.

In Gyeonggi and Incheon, while the rise rate in Gimpo City, where regulation possibilities have increased, dropped from 0.36% to 0.14%, areas with 3rd phase new towns such as Namyangju and Hanam saw an expansion in rise rates due to expectations for improvements in transportation and infrastructure. The rise order was Namyangju (0.26%), Hanam (0.25%), Seongnam (0.20%), Gwangmyeong (0.18%), Yongin (0.16%), Uiwang (0.16%), Anyang (0.15%), and Gimpo (0.14%). In Namyangju, Ssangyong Yega in Toegyewon-eup, Jinjeop Centreville City 1 Complex in Jinjeop-eup, and Changhyeon Doosan 2 Complex in Hwado-eup rose by 2.5 to 10 million KRW. In Hanam, Kkumdongsan Sinan in Changwoo-dong and Daemyeong Riverside Town in Sinjang-dong rose by 5 to 10 million KRW. In Seongnam, Jugong Atville in Hadaewon-dong and Humancia Seom Village 5 Complex in Dochon-dong rose by 10 million KRW.

The jeonse (long-term lease) market saw a rise of 0.09% in Seoul due to a worsening shortage of listings. Gyeonggi, Incheon, and new towns all rose by 0.05%, showing similar rates of change as the previous week.

In Seoul's jeonse market, overall listings are scarce, and areas designated as land transaction permission zones such as Gangnam saw a reduction in rental listings, leading to larger increases in jeonse prices. The rise order was Geumcheon (0.20%), Gangnam (0.19%), Songpa (0.19%), Gangdong (0.18%), Seongbuk (0.11%), Guro (0.10%), Gangbuk (0.09%), Gangseo (0.08%), Gwangjin (0.08%), and Nowon (0.06%). In Geumcheon, Seongji in Siheung-dong and Sindoblaenu rose by 5 to 25 million KRW. In Songpa, Jamsil Jugong 5 Complex in Jamsil-dong, Jamsil Parkrio in Sincheon-dong, and Olympic Athletes' Village in Bangi-dong rose by 10 to 20 million KRW. In Gangdong, Dunchon Prugio in Dunchon-dong and Donga Highville in Cheonho-dong rose by 2.5 to 10 million KRW.

New towns rose in the following order: Ilsan (0.08%), Dongtan (0.08%), Pyeongchon (0.07%), Gimpo Hangang (0.06%), Gwanggyo (0.06%), and Bundang (0.05%). In Ilsan, Munchon 2 Complex Life in Juyop-dong, Baekma 2 Complex Geukdong Samhwan in Madu-dong, and Baeksong 3 Complex Hanshin in Baekseok-dong rose by 2.5 to 5 million KRW. In Dongtan, Dongtan 2 Sinan Insville Vera 1st Complex in Cheonggye-dong, Dongtan Bando Yubora Ivy Park 2nd Complex in Yeongcheon-dong, and Dongtan Pureunmaeul Doosan We’ve in Neung-dong rose by 5 million KRW. In Pyeongchon, Mugunghwa Hanyang and Mugunghwa Taeyoung in Hogye-dong and Hyangchon Hyundai 4th Complex in Pyeongchon-dong rose by 5 million KRW. In Gimpo Hangang, e-Pyeonhan Sesang Hangang New Town 2nd Complex in Masan-dong and Gurae Station Hwaseong Park Dream in Gurae-dong rose by 5 million KRW.

In Gyeonggi and Incheon, the rise order was Yangju (0.33%), Hanam (0.29%), Namyangju (0.14%), Seongnam (0.13%), Uiwang (0.12%), Gwangmyeong (0.07%), Gunpo (0.07%), Yongin (0.07%), and Uijeongbu (0.07%). In Yangju, Okjeong Sechang Live House in Okjeong-dong rose by 15 million KRW. In Hanam, Hansol Richville 3rd Complex in Deokpung-dong and Daemyeong Riverside Town in Sinjang-dong rose by 10 million KRW. In Namyangju, Jinjeop Centreville City 2nd Complex in Jinjeop-eup and Dasan Yuseung Hannaedeul Central in Dasan-dong rose by 7.5 to 10 million KRW.

Despite the June 17 measures, the rise in housing prices in Seoul and the metropolitan area has not subsided, prompting discussions on additional measures. These include designating the Gimpo area, which has experienced balloon effects, as a regulated area, strengthening comprehensive real estate taxes on multiple homeowners, expanding pre-subscription quantities for 3rd phase new towns, and tax benefits for first-time homebuyers. Yoon Ji-hae, senior researcher at Real Estate 114, said, "The more the government tightens regulations, the more the shortage of listings deepens." He added, "Before the regulations took effect, many actual demand buyers rushed to transact at the end of June, and after the regulations began in July, homeowners are reluctant to list their properties to maintain loan conditions." He pointed out, "The government is rushing to expand housing supply to resolve this shortage, but it will still take considerable time before actual supply is realized."

The jeonse market is also experiencing a rise across the metropolitan area due to a shortage of listings. He said, "Due to the burden of holding taxes and ultra-low interest rates, jeonse listings are likely to convert to monthly rent, and with strengthened residency obligations for owners, jeonse listings themselves will become scarce." He forecasted, "With loan regulations under the June 17 measures, more people will choose jeonse residence over purchase or wait for subscription, continuing upward pressure on prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.