Loan Industry Unable to Operate Normally Even at Current 24% Rate

Savings Banks' Effective Interest Rates Already Below 20%

Financial Authorities Take Cautious Stance... "Reviewing Market Conditions"

[Asia Economy Reporter Kim Min-young] A bill to lower the legal maximum interest rate to below 20% per annum was introduced simultaneously with the opening of the 21st National Assembly. It is expected that once the standing committees of the National Assembly are formed, the bill will be actively discussed, influenced by the overwhelming victory of the Democratic Party of Korea, which pledged to reduce the legal maximum interest rate in the recent general election. However, there are concerns that vulnerable groups rated below grade 7 might be pushed into illegal private loans, a chronic issue.

According to political and financial circles on the 2nd, Kim Cheol-min, a member of the Democratic Party of Korea, took the lead in proposing amendments to the Interest Limitation Act and the Act on Registration of Credit Business and Protection of Finance Users (Credit Business Act) to lower the current maximum interest rate of 24% to 20%, a 4 percentage point reduction.

The amendment to the Interest Limitation Act lowers the maximum interest rate to 20% and stipulates that unless there is a special agreement between the parties, the total interest amount cannot exceed the loan principal.

Regarding the Credit Business Act, the current maximum interest rate is set higher than the Interest Limitation Act at 27.9% per annum (24% or less according to the enforcement decree), but the amendment aims to unify this by applying the Interest Limitation Act’s 20% rate.

Representative Kim explained, “Everyone is going through a difficult time due to the novel coronavirus disease (COVID-19), and with analyses suggesting that the economic growth rate may fall into negative territory due to the global crisis, I prioritized stabilizing the livelihood economy and prepared the first bill of the 21st National Assembly.”

The reduction of the maximum interest rate was a pledge of the Democratic Party in the 21st general election and also a campaign promise of President Moon Jae-in. Twelve ruling party lawmakers, including Kim, Nam In-soon, Do Jong-hwan, Ahn Min-seok, Yoon Kwan-seok, and Hwang Hee, signed the bill.

The same bill was introduced in the 20th National Assembly but was discarded due to the end of the session. However, with the Democratic Party merging with the proportional representation party, the Together Citizens’ Party, creating a ‘super ruling party’ with 180 seats, the bill is likely to pass this time.

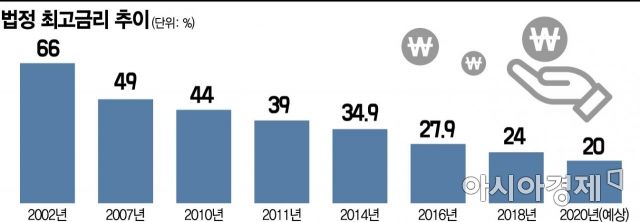

The maximum interest rate was first set at 66% under the Credit Business Act in 2002, then lowered to 49% in 2007, 44% in 2010, and 39% in 2011. Subsequently, it was reduced every two years to 34.9% in 2014, 27.9% in 2016, and 24% in February 2018.

The lending industry, which is directly affected by the reduction of the maximum interest rate, is in ‘ultra-alert’ mode. The industry expressed concerns that the loan access for low-credit borrowers would be blocked immediately. An industry official said, “If lending companies reduce loans while managing risks, low-credit borrowers will face a ‘loan cliff,’ and their only option will be illegal private loans.”

The industry claims that the lending market has already been devastated under the 24% maximum interest rate system. Following Sanwa Money, the industry leader that stopped new loans last year, Jo Credit Credit, ranked fourth, also halted new loans starting January. According to the Credit Finance Association, among the 22 top companies reporting interest rates on unsecured loans to the association, six companies issued fewer than 10 loans in the first quarter, effectively suspending operations.

Savings banks argue that loan interest rates are sufficiently low even under the current maximum interest rate. An industry official said, “The personal credit loan interest rate dropped from 20.25% in February 2018 to 17.07% last April, so further reduction of the maximum interest rate is meaningless.”

The financial authorities are taking a cautious stance. While there is no disagreement about policy coordination with the government and ruling party, they are concerned that a premature reduction might block funding for low-credit borrowers. In an October press briefing last year, Eun Sung-soo, Chairman of the Financial Services Commission, said, “If interest rates are artificially lowered and companies stop lending because business is not profitable, consumers will have to turn to the higher-interest private loan market,” and added, “The timing of lowering the maximum interest rate will be decided based on the financial market situation.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.