[Asia Economy Reporter Eunmo Koo] Goldman Sachs reported that its fourth-quarter earnings last year fell short of expectations due to increased costs.

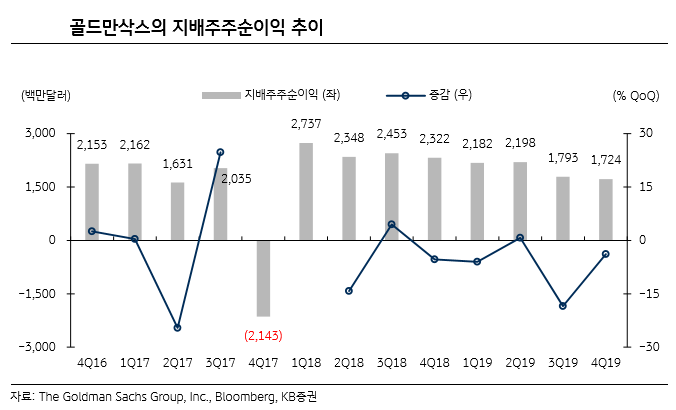

On the 18th, KB Securities stated that Goldman Sachs' fourth-quarter net income attributable to controlling shareholders last year decreased by 25.8% year-on-year to $1.72 billion, missing the Bloomberg consensus of $2.03 billion by 14.9%. During the same period, net operating revenue rose 23.2% to $9.96 billion, surpassing the market consensus of $8.56 billion due to increased gains from equity operations and higher trading volumes in FICC (fixed income, currencies, and commodities). However, the company recorded earnings below market expectations as it reflected part of the fines related to the 1MDB scandal as expenses in the fourth quarter of last year.

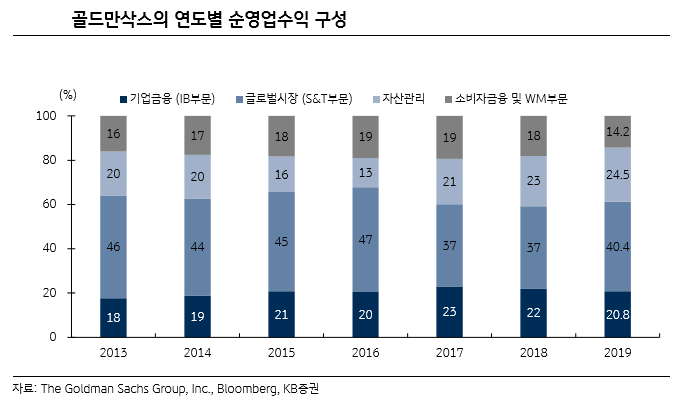

The increase in costs was analyzed as a burden on last year's performance. Namseok Lee, a researcher at KB Securities, explained, "Goldman Sachs' net operating revenue last year was $36.55 billion, similar to the previous year's $36.62 billion, while net income attributable to controlling shareholders was $8.47 billion, down 19.1% year-on-year. This was due to one-time expenses recorded in the fourth quarter of last year and increased costs during the initial business stabilization process to strengthen the retail channel." Goldman Sachs maintains a strategy to diversify its revenue structure, which has been concentrated on investment banking (IB) and trading, into retail and asset management sectors through initiatives such as the online banking platform Marcus and the launch of the Apple credit card.

It is analyzed that the decline in stock price due to profit reduction was defended by maintaining an active shareholder return policy. Researcher Lee stated, "Despite the profit decline caused by increased costs, the stock price has maintained a favorable trend by sustaining a return on equity (ROE) of 10% through an active shareholder return policy. In 2019, 81% of net income attributable to controlling shareholders, amounting to $6.88 billion (including $5.34 billion in share repurchases and $1.54 billion in cash dividends), was used as shareholder return resources," he explained.

Risk factors pointed out include a decrease in financial product trading volume due to market stagnation and a reduction in investment gains and losses caused by increased stock market volatility.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.