Innospace Shares Plunged 29% on December 23

Stock Price Rebounds Rapidly This Year

Securing Flight Data Seen as a 'Meaningful Achievement'

Shares of Innospace, which attempted its first commercial launch at Brazil's Alcantara Space Center late last year but failed, are showing a rapid recovery. Following the failed launch, the company received positive evaluations for its technological achievements and data collection. In addition, the government's decision to further strengthen support for private launch vehicle companies has fueled expectations for the success of future commercial launches, driving up the company's valuation.

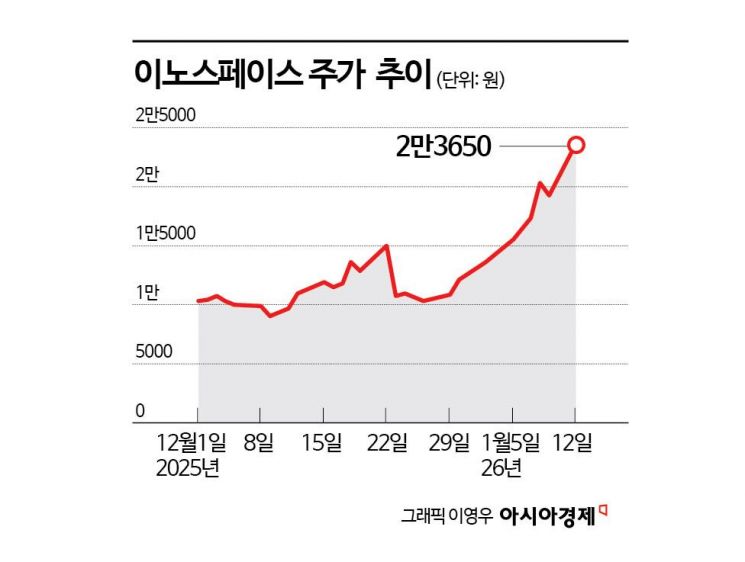

According to the financial investment industry on January 13, Innospace's share price rose to 23,650 won, marking a 120.8% increase compared to December 23 of last year. During this period, foreign and institutional investors recorded net purchases of 8.7 billion won and 7.1 billion won, respectively.

Previously, on December 23 of last year, Innospace shares closed at 10,710 won, plunging 28.6% from the previous day. On the same day, Innospace's first commercial launch vehicle, Hanbit-Nano, was launched from Brazil's Alcantara Space Center. However, as footage of the rocket engulfed in flames immediately after launch was broadcast live, a wave of sell orders from investors followed.

At the time, the company explained that the launch vehicle successfully ignited its 25-ton-class hybrid rocket engine in the first stage and completed the planned flight segment. However, about 30 seconds after liftoff, an anomaly occurred during flight, and the launch vehicle fell into a pre-designated safety zone.

Innospace is currently working with relevant agencies to comprehensively analyze flight and measurement data and review the technical causes. Although the rocket failed to reach its target orbit, it is considered significant that the company collected key data that can only be obtained in an actual flight environment. The company expects to use this data to further refine its designs and enhance operational stability and reliability.

The rapid recovery in share price despite the failed commercial launch is underpinned by optimism surrounding the entire aerospace industry. Lee Sangheon, a researcher at iM Securities, explained, "As the industry transitions from the Old Space era to the New Space era, the space sector is entering a phase of high growth. The full-scale entry of private companies is accelerating both the pace and scale of industry change."

Government policy has also contributed to the recovery in investor sentiment. The Korea Aerospace Administration has decided to expand support so that private launch vehicle companies can continue repeated trials and accumulate technology. This move takes into account the example of SpaceX in the United States, which grew through multiple launches and failures with government support. According to the "2026 Comprehensive Implementation Plan for Aerospace Administration R&D Projects," the Korea Aerospace Administration plans to invest a total of 949.5 billion won in research and development. In the launch vehicle sector, the agency will pursue new projects related to small launch vehicles in addition to the ongoing development of the Nuri rocket and next-generation launch vehicles.

The prospect of being able to offset past failures with a successful commercial launch is also boosting the company's valuation. By the end of last year, Innospace had signed 15 contracts related to launch services, with a total contract value of about 32.5 billion won. If the company attempts another commercial launch this year and succeeds, it is expected to fully commercialize its launch service business. As the number of successful launches increases, the likelihood of securing more orders also rises.

Researcher Lee added, "Innospace's hybrid rocket propulsion technology will be widely used in the defense sector. Because it allows for thrust control and re-ignition according to mission requirements, it can be applied to air-to-air, air-to-ground, and surface-to-surface missiles."

He continued, "In February of last year, Innospace signed a contract with LIG Nex1 to supply three types of mock launch vehicles worth 11.3 billion won, marking its full-fledged entry into the defense market. As the trend toward strengthening national defense continues, this is expected to lead to an expansion of defense sector orders."

However, the financial investment industry has expressed concerns that, given the rapid rise in Innospace's share price, volatility could increase going forward.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![$29 Monthly Subscription AI Plant Appliance... US Startup Challenges LG [CES 2026]](https://cwcontent.asiae.co.kr/asiaresize/319/2026010819285284553_1767868133.png)