Losses Reduced by 45.9% Year-on-Year

Annual Operating Profit More Than Doubled from Previous Year

ESS Expansion Amid Setbacks from Canceled EV Contracts

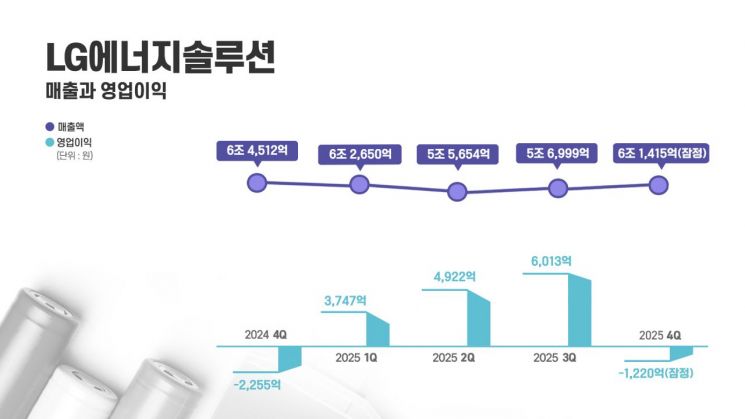

LG Energy Solution reported provisional consolidated results for the fourth quarter of last year, with sales of 6.1415 trillion won and an operating loss of 122 billion won. Compared to the same period last year, sales declined by 4.8%, and the company continued to post an operating loss. However, on an annual basis, the company maintained its trend of improved performance. As the slowdown in electric vehicle demand is accelerating, exemplified by the cancellation of North American electric vehicle battery supply contracts worth about 14 trillion won, the company announced plans to accelerate its portfolio shift toward energy storage systems (ESS).

On January 9, LG Energy Solution disclosed its provisional results for the fourth quarter of 2025. While sales saw a slight decrease due to the slowdown in electric vehicle demand and inventory adjustments by clients, the operating loss was nearly halved as cost structure adjustments and expanded North American production took effect. The scale of the loss was reduced by 45.9% compared to the operating loss of 225.5 billion won in the same period last year. Excluding the approximately 330 billion won in Advanced Manufacturing Production Credit (AMPC) under the U.S. Inflation Reduction Act (IRA), the operating loss for the fourth quarter would be 454.8 billion won, with an operating margin of -7.4%.

On the 10th, LG Energy Solution headquarters on Yeouidaero, Yeongdeungpo-gu, Seoul. Photo by Kang Jinhyung aymsdream@

On the 10th, LG Energy Solution headquarters on Yeouidaero, Yeongdeungpo-gu, Seoul. Photo by Kang Jinhyung aymsdream@

According to the battery industry, the main reasons for the deterioration in fourth-quarter results were the decrease in electric vehicle pouch battery orders from core clients and the initial cost burden from the additional operation of North American ESS lines. Last month, LG Energy Solution terminated battery supply contracts worth approximately 9.6 trillion won with Ford in the United States and 3.9217 trillion won with FBPS. In the previous third-quarter earnings announcement, LG Energy Solution had stated, "A decrease in shipments of high-profit North American electric vehicle products and temporary impacts from the operation of the Georgia plant make a short-term profit decline in the fourth quarter inevitable."

On an annual basis, the company showed improved performance. Cumulative sales for 2025 reached 23.6718 trillion won, a 7.6% decrease from the previous year, but cumulative operating profit was 1.3461 trillion won, a 133.9% increase compared to the same period last year (575.4 billion won). Analysts attribute the annual performance resilience to the tax credit effect from increased North American production and the alleviation of fixed cost burdens.

In his New Year's address, LG Energy Solution CEO Kim Dongmyung identified the following as key priorities: maximizing the growth potential of the ESS business, strengthening product competitiveness and cost competitiveness, securing research and development (R&D) capabilities, and accelerating execution based on artificial intelligence transformation (AX). He conveyed the message that the company aims to reinforce its structural competitiveness by adjusting its portfolio beyond the electric vehicle-centered structure.

Shinhan Investment Corp. commented, "Short-term performance adjustments are inevitable due to the suspension of operations at Ultium Cells Plants 1 and 2 in North America during the first half of the year, but on an annual basis, we expect a 'lower first half, higher second half' trend. The expansion of ESS demand centered in North America and the strengthening trend of decoupling from China will serve as mid- to long-term momentum." Mirae Asset Securities also projected a recovery in performance, citing increased operating rates at ESS conversion lines and the potential rebound in European electric vehicle demand in the second half of the year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![$29 Monthly Subscription AI Plant Appliance... US Startup Challenges LG [CES 2026]](https://cwcontent.asiae.co.kr/asiaresize/319/2026010819285284553_1767868133.png)