62.5% of Companies Name China as Their Top Competitor

China Already Leads Korea in Five Major Sectors

Maintaining a Significant Lead Over China Becomes a Core Challenge

Large-Scale Investments by Samsung, Hyundai Motor, and Others

Expected to

Following steel and display industries, it is now projected that even semiconductors, electrical and electronics, and shipbuilding-South Korea's top 10 export-driving sectors-will all fall behind China in competitiveness within the next five years. This is because it is becoming increasingly difficult for domestic companies to effectively respond to the relentless advance of Chinese manufacturing, which wields cost competitiveness and production innovation as its primary weapons. Notably, some analysts warn that even the brand value of Korean companies and products, once symbolized by the letter 'K', could be overtaken by China within a few years. As a result, maintaining a gap with China, which is rapidly enhancing its technological capabilities and production capacity, is emerging as a critical challenge.

Some believe that the decision by major groups such as Samsung and SK to invest hundreds of trillions of won in next-generation production capabilities-including semiconductors, artificial intelligence (AI), and robotics-will help secure a significant lead over China.

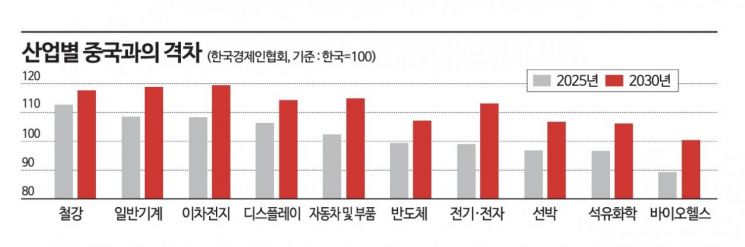

According to a survey conducted by the Korea Economic Research Institute on November 17, targeting the top 1,000 companies by sales in export-oriented sectors (with responses from 200 companies), China has already surpassed Korea in five sectors: steel, general machinery, secondary batteries, displays, and automobiles and parts. While Korea currently maintains an edge in semiconductors, electrical and electronics, shipbuilding, petrochemicals, and biohealth, many respondents expect China to overtake Korea in these sectors as well by 2030. The 10 major export-driving sectors included in the survey were selected based on export-import trends from the Ministry of Trade, Industry and Energy.

This survey was conducted to gauge the level of competition that domestic companies are actually experiencing, amid growing concerns about intensifying competition with Chinese firms in the global market. In the survey, 62.5% of responding companies identified China as their top export competitor this year. The proportion rose to 68.5% when asked about expectations for 2030. When asked to rate the competitiveness of other countries on the assumption that Korea’s corporate competitiveness is '100', respondents gave the following scores for this year: United States 107.2, China 102.2, and Japan 93.5. By 2030, these figures are expected to be: United States 112.9, China 112.3, and Japan 95.0.

When comparing competitiveness by category, China already surpasses Korea in price competitiveness and productivity, and respondents expect that by 2030, China will also overtake Korea in brand value. The Korea Economic Research Institute explained that, given the pace of China’s technological innovation, the brand competitiveness of Korean companies could also be at risk.

Among companies that identified China as their top competitor, the survey found that as of this year, China’s competitiveness compared to Korea by category was as follows: price competitiveness (130.7), productivity (120.8), government support (112.6), skilled workforce (102.0), core technology (101.8), and product brand (96.7). By 2030, China is expected to surpass Korea in all categories: price competitiveness (130.8), productivity (123.8), government support (115.1), skilled workforce (112.4), core technology (111.4), and product brand (106.5).

Companies point out that, given the rapid pace of China’s technological innovation, it will be difficult to maintain the current gap with only existing manufacturing and technological systems. The recent decisions by Samsung, SK, Hyundai Motor, and LG to invest hundreds of trillions of won in domestic sectors such as semiconductors, AI, and robotics-as a follow-up to Korea-US tariff negotiations-are also seen as a move to keep China in check. Many experts believe that, considering the speed of China’s pursuit, large-scale investments in next-generation industries such as high-bandwidth memory (HBM), all-solid-state batteries, AI data centers, and robotics will be essential to secure a significant lead going forward. Yoo Hoejun, Professor of Electrical and Electronic Engineering at KAIST, stated, "It is important to connect technology to industrialization," and analyzed, "Expanding quantitative investment will increase the likelihood of maintaining a significant lead."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.