KOSPI Down 2.3% This Month

Turns Negative for the First Time in Three Months

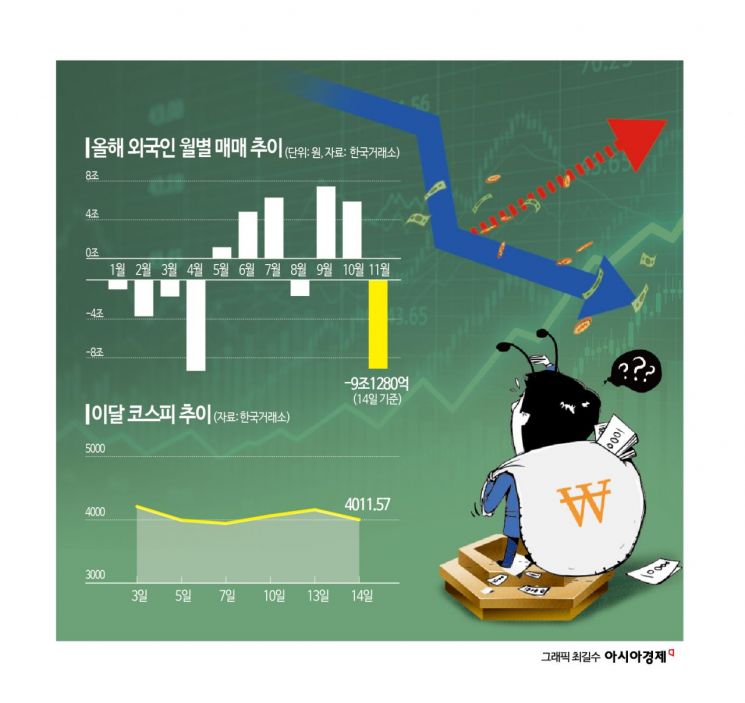

Foreign Investors Sell Over 9 Trillion Won in November

Short-Term Volatility Unavoidable for Now

The KOSPI has recorded a negative return for the first time in three months, indicating an ongoing market correction. As the factors that previously supported the KOSPI's rise have shifted, volatility is increasing. Foreign investors, who had been driving the KOSPI's upward momentum, have switched to net selling this month, offloading more than 9 trillion won. Expectations for a U.S. interest rate cut have diminished, and profit-taking in the semiconductor sector has surged due to concerns over the high valuation of artificial intelligence (AI) stocks. Experts say that while short-term volatility is inevitable, the upward trend is expected to continue, considering improvements in corporate earnings and policy momentum.

As of 9:30 a.m. on November 17, the KOSPI was trading at 4,067.95, up 56.38 points (1.41%) from the previous session. After a sharp decline in the previous trading day, the market is rebounding within a day. On November 14, the KOSPI had dropped 3.81%, falling below the 4,100 mark.

The index movement appears to be largely determined by foreign investors. On this day, foreigners were net buyers in the KOSPI market, which seems to be driving the index higher. On November 14, foreign investors sold 2.3574 trillion won, marking the largest net selling volume of the year and causing the index to plunge by 3.81%.

Foreign investors have turned to net selling for the first time in three months, with a cumulative net sale of 9.128 trillion won so far this month. Kim Daejun, a researcher at Korea Investment & Securities, said, "KOSPI volatility has been rising in November, and the rapid increase in foreign net selling came right after the KOSPI hit an all-time high of 4,221.87 points at the close on November 3." He added, "Foreigners generally maintained a selling bias from November 4 to 14, with net selling exceeding 2 trillion won on the 4th, 5th, and 14th, putting pressure on the market."

Na Jeonghwan, a researcher at NH Investment & Securities, noted, "The sector most affected by foreign net selling has been semiconductors, likely due to profit-taking and concerns over the high valuation of artificial intelligence (AI) stocks." He also pointed out, "The further rise in the won-dollar exchange rate is another factor weakening foreign inflows."

Although large-scale selling by foreign investors can trigger anxiety, some analysts believe this will not halt the KOSPI's upward momentum. Han Jiyeong, a researcher at Kiwoom Securities, said, "Although only two weeks have passed, foreign net selling in the KOSPI this month amounts to about 9.1 trillion won, the third largest since 2000." He continued, "Such aggressive net selling is enough to unsettle the market, but it is more about profit-taking in semiconductor stocks amid the AI bubble debate, rather than signaling the end of the KOSPI bull market." He added, "With macroeconomic events such as Nvidia's earnings, statements from U.S. Federal Reserve officials, and September employment data scheduled for this week, it is difficult to expect a swift turnaround to net buying by foreigners. However, considering the solid earnings momentum for KOSPI companies and the stabilization of the exchange rate surge, it is more appropriate to assume that foreign net selling will subside rather than intensify."

Nvidia's earnings are expected to serve as a key inflection point. Nvidia will announce its third-quarter results on November 19 (local time). Jo Joongi, a researcher at SK Securities, said, "Nvidia's earnings announcement will likely provide a short-term conclusion to the AI bubble concerns." He added, "The two stocks most heavily sold by foreigners last week were SK Hynix and Samsung Electronics, with their net selling volumes exceeding the total net selling by foreigners in the KOSPI spot market last week. A signal from Nvidia's earnings that could halt the selling trend is needed."

Although a short-term correction is possible, the upward trend is expected to continue. Na Jeonghwan, a researcher at NH Investment & Securities, said, "The KOSPI may undergo a short-term correction, but considering expectations for improved domestic corporate earnings and policy momentum, the upward trend will likely persist." He explained, "While external uncertainties remain in the short term, domestic policy momentum is still valid, and stock market activation policies such as the mandatory retirement of treasury shares and the National Growth Fund are also becoming more visible."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.