Insurance Companies and Consumers Must Work Together:

"Excessive Competition and Compensation Mindset Lead to Fraud"

Insurers and Government Should Strive to Improve Public Perception of Insurance

"Expanding Reward Programs Also Has Positive Effects"

"After all the premiums I've paid so far, why are you making such a fuss over me claiming just this one time?"

This is the most common statement heard by insurance fraud investigation and enforcement teams from insurance fraudsters. Some even commit illegal acts and then lash out, accusing wealthy insurance companies of labeling them as criminals simply because they do not want to pay out claims. There are also cases where people retaliate against investigative agencies with malicious complaints, questioning why the government always sides with insurance companies.

Although experts from various fields have proposed multiple measures to prevent insurance fraud, the most effective solution is a shift in public perception. If you have consistently paid your premiums but have rarely claimed insurance money, it is proof that you are healthy, not something to feel wronged about. Many people mistakenly believe that the premiums they have paid must be returned to them in the future as a form of "getting their money's worth," which is a misunderstanding often caused by confusion with certain savings-type, cash-value, or annuity insurance products.

Insurance, by its very nature, inevitably contains an element of gambling, since it allows for the possibility of receiving a large payout for a relatively small premium. The sense of unfairness or desire for compensation felt by those who have never received a payout, unlike others, also plays a role. This makes it easy to fall into the temptation of fraud. The insurance funds managed by insurance companies are actually a collective reserve prepared by many people in similar situations, but some mistakenly perceive it as the insurance company's money. Recently, when the government moved to reform indemnity health insurance and auto insurance, where insurance payouts have been leaking significantly, there was a surge of criticism questioning, "Why is the government helping insurance companies make money?" This alone demonstrates how widespread these misconceptions are.

A depiction of a customer who holds a negative perception of insurance and exhibits moral hazard, as described by ChatGPT. ChatGPT

A depiction of a customer who holds a negative perception of insurance and exhibits moral hazard, as described by ChatGPT. ChatGPT

Strengthening Education and Public Awareness to Improve Perceptions of Insurance

Experts unanimously agree that public perceptions of insurance must change. They advise that the government should actively promote education and public awareness campaigns to improve understanding.

Kim Yongha, a professor in the Department of IT Finance and Management at Soonchunhyang University (former president of the Korea Institute for Health and Social Affairs), stated, "Insurance is a system designed to help one another in times of hardship, utilizing the 'law of large numbers,' where many people join and the insurance payout goes to those who experience accidents." He added, "There is a need for education to dispel the mistaken belief that you must get your money's worth simply because you paid premiums." Choi Byungkyu, a professor at Konkuk University Law School (former president of the Korean Insurance Law Association), said, "Misconceptions about insurance contribute to the spread of insurance fraud," and emphasized, "It is necessary to instill the understanding that insurance fraud is a serious crime through mindset reform campaigns, education, and public awareness initiatives."

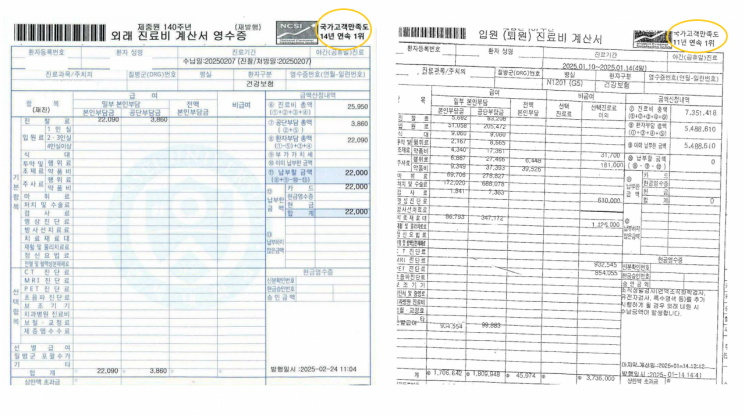

An insured person forging a medical expense receipt to submit to the insurance company. Based on the template of a genuine receipt, the detailed items were altered flawlessly. The insurance company barely detected the fraud by noticing that the National Customer Satisfaction Index (NCSI) award records at the top differed, showing "14 consecutive years" and "11 consecutive years." From left to right: genuine receipt, forged receipt. Samsung Fire & Marine Insurance

An insured person forging a medical expense receipt to submit to the insurance company. Based on the template of a genuine receipt, the detailed items were altered flawlessly. The insurance company barely detected the fraud by noticing that the National Customer Satisfaction Index (NCSI) award records at the top differed, showing "14 consecutive years" and "11 consecutive years." From left to right: genuine receipt, forged receipt. Samsung Fire & Marine Insurance

Insurance Companies Should Also Avoid Competing to Launch High-Coverage Products

Insurance companies also bear significant responsibility for fostering misconceptions about insurance among the public. Examples include enticing consumers by competitively increasing coverage amounts or engaging in "limited-time" hard-sell marketing tactics.

Kim Heonsu, a professor in the Department of IT Finance and Management at Soonchunhyang University (co-vice chair of the "Growth and Integration" Finance Division), pointed out, "Excessive competition among insurance companies has led to a lack of product restraint and weakened defenses against insurance fraud." He added, "Insurance companies themselves should limit the release of products that are vulnerable to insurance fraud." Professor Kim also suggested that policies should be implemented to reflect insurance fraud risk management capabilities in the compensation and performance evaluations of insurance company CEOs.

Byun Hyewon, a research fellow at the Korea Insurance Research Institute, stated, "When developing insurance products, it is crucial to thoroughly assess whether they might induce moral hazard among consumers." She also noted, "The lower the level of trust in insurance companies, the easier it is for individuals to rationalize engaging in 'soft insurance fraud' on impulse, so insurance companies must make continuous efforts to build trust."

An image created by ChatGPT depicting insurance companies competitively launching high-coverage products to mislead consumers. ChatGPT

An image created by ChatGPT depicting insurance companies competitively launching high-coverage products to mislead consumers. ChatGPT

Expanding Reward Programs Is Also a Good Alternative for Preventing Insurance Fraud

There are also calls to further expand reward programs to prevent insurance fraud at an early stage. The insurance fraud reward program pays a reward to individuals who report suspected insurance fraud. It is jointly operated by the Financial Supervisory Service and the Korea Life Insurance and General Insurance Associations. The maximum reward is 2 billion won.

Lee Yunho, professor emeritus of police administration at Dongguk University, remarked, "Organized insurance fraud is a crime that is difficult to uncover without insider information or tips," and added, "Just as bigger fishing floats attract bigger fish, expanding the reward program would not be a bad idea." Ha Taeheon, an attorney at Sejong Law Firm, said, "Rewards help restrict the movement of criminal organizations," explaining, "To commit insurance fraud, you need to recruit more accomplices outside the organization, but if the reward increases, suspicion that someone might report grows, which can serve as a form of crime prevention."

Last year, despite their busy lives, citizens reported 4,452 cases of insurance fraud to insurance companies and the Financial Supervisory Service. As a result, 52.1 billion won in insurance payouts was protected. A total of 1.52 billion won in rewards was paid to informants. This shows that the driving force steering our society in the right direction does not come only from grand institutions or systems, but from the actions of ordinary citizens quietly upholding justice behind the scenes.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.