Fifth Attempt to Sell MG Insurance Fails

Liquidation Procedures May Follow

Meritz Fire & Marine Insurance has decided to give up on acquiring MG Insurance.

On the 13th, Meritz Fire & Marine Insurance announced, "Although we were selected as the preferred negotiation partner for the asset and liability transfer (P&A) deal, including MG Insurance's insurance contracts, by the Korea Deposit Insurance Corporation, we have decided to relinquish our position due to differences in stance among the involved institutions." With this, the fifth attempt to sell MG Insurance has ultimately failed.

Since being selected as the preferred negotiation partner in December last year, Meritz Fire & Marine Insurance faced strong opposition from the MG Insurance labor union, causing delays in negotiations. The MG Insurance branch of the National Union of Office and Financial Service Workers has consistently demanded that Meritz Fire & Marine Insurance abandon the acquisition, arguing that employment succession is not guaranteed. The union also did not cooperate with Meritz Fire & Marine Insurance’s due diligence. Last month, the Korea Deposit Insurance Corporation responded by filing a court injunction to prohibit interference with business against the union.

On the 10th, the Korea Deposit Insurance Corporation and the MG Insurance union appeared to make progress in negotiations when the union agreed to due diligence on the condition that the 115 documents requested by Meritz Fire & Marine Insurance be reduced to 55 categories. Meritz Fire & Marine Insurance also proposed a negotiation plan through the Korea Deposit Insurance Corporation that included employment succession for 10% of all employees and a non-employment consolation payment of 25 billion KRW. However, as the union did not accept Meritz Fire & Marine Insurance’s proposal and negotiations were delayed again, it appears that Meritz Fire & Marine Insurance ultimately decided to abandon the acquisition.

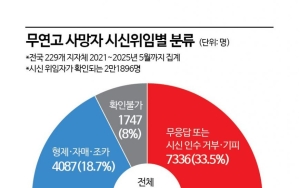

With the collapse of the MG Insurance sale, there is a possibility that MG Insurance will undergo liquidation procedures. If liquidation proceeds, 1,242,600 customers (with 1.56 million contracts) will be compensated up to 50 million KRW according to the Depositor Protection Act, and insurance contracts will be forcibly terminated. Amounts exceeding 50 million KRW are expected to result in customer losses. The Korea Deposit Insurance Corporation is currently considering three options: additional public sale, liquidation/bankruptcy, and insurance contract transfer to another insurer.

The predecessor of MG Insurance was the former Green Insurance. In 2012, due to deteriorating management, it was designated as a financially distressed institution by the Financial Services Commission, prompting efforts to sell it. In 2013, the National Credit Union Federation of Korea acquired it and changed its name to the current one, but financial difficulties persisted. Subsequently, the Financial Services Commission entrusted the sale to the Korea Deposit Insurance Corporation in 2023, and although five acquisition attempts including Meritz Fire & Marine Insurance were made, they ultimately failed.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.