After Hitting a 52-Week Low on the 4th, Hyundai Motor Achieves a Rebound

U.S. Auto Tariff Suspension for One Month Eases Tariff Risk

Stock Price Volatility Unavoidable Due to Tariffs and Exchange Rates Rather Than Sales Performance for Now

Confirmation Needed on Tariff Details in Early April

Hyundai Motor has hit a bottom and started a rebound. However, as it is still within the scope of U.S.-imposed tariffs, stock price fluctuations due to tariffs are expected to continue.

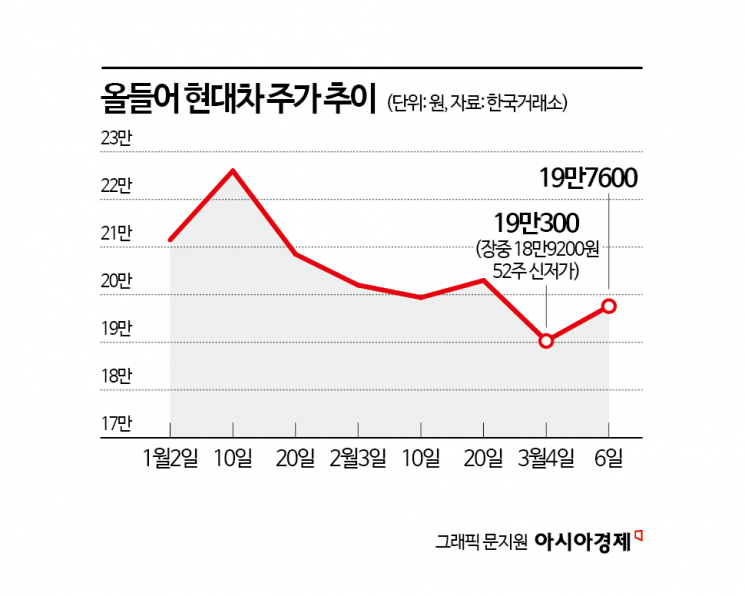

According to the Korea Exchange on the 7th, Hyundai Motor closed at 197,600 KRW, up 1.49% from the previous day. After hitting a 52-week low of 189,200 KRW during trading on the 4th, the stock rose for two consecutive days, successfully rebounding.

This stock price strength is interpreted as a result of somewhat eased concerns over U.S. auto tariffs. The U.S. announced a 25% tariff on Mexico and Canada, but just one day later, on the 5th, it decided to suspend tariffs on the auto sector for one month.

Despite the stock market showing a favorable trend this year, Hyundai Motor's stock price has fallen 6.79%. The stock, which had risen to 220,000 KRW at the beginning of the year, is now trading in the 190,000 KRW range. This is because the negative impact from tariffs continues despite solid sales performance. Yongkwon Moon, a researcher at Shin Young Securities, said, "Cumulative global wholesale sales of Hyundai Motor in February were similar to last year, and Kia's sales increased by 1%. Considering the 9% rise in the won-dollar exchange rate compared to the first quarter of last year, along with price and volume effects, the sales trend sufficiently meets the consensus revenue forecast (average securities firm forecast) for the first quarter of this year, which is a 6% increase compared to the same period last year." He added, "Nevertheless, Hyundai Motor and Kia's stock prices have fallen 25.5% and 25.7%, respectively, compared to a year ago. As of the closing price on the 4th, they are trading near the lower end of valuation since 2021, with a 12-month forward price-to-earnings ratio (PER) of 3.9 times and 3.6 times, respectively. This is due to increased uncertainty over U.S. tariffs, the largest export market, amid changes in competitive paradigms such as autonomous driving."

Concerns over tariffs led to net selling by foreigners and institutions, dragging down the stock price. This year, foreigners have net sold Hyundai Motor shares worth 995.7 billion KRW, making it the second most sold stock after Samsung Electronics, while institutions have net sold 265 billion KRW, the largest amount sold.

Although it succeeded in rebounding after hitting a bottom, whether the upward trend can continue remains uncertain. This is because the tariff issue still holds it back. Kwangrae Park, a researcher at Shinhan Investment Corp., said, "In the short term, variables such as tariffs and exchange rates will have a greater impact on stock prices than sales performance," adding, "Regarding U.S. tariffs, until the final plan is announced, it will act as a factor increasing stock price volatility."

There is an opinion that it is necessary to wait until early April. Junsung Kim, a researcher at Meritz Securities, said, "Since the possibility of tariff imposition decisions on the Korean auto industry and the resumption of tariffs on Mexico and Canada coexist until early April, it is judged that structural corporate value improvement will be determined after confirming these matters." Munsu Jang, a researcher at Hyundai Motor Securities, said, "The stock price discount in the auto sector is expected to be resolved depending on four momentum factors: concretization of collaboration with General Motors (GM), Toyota, Waymo, Nvidia, and Samsung; the unveiling of Hyundai Motor Group's mobility open platform Pleos; investment related to batteries with Boston Dynamics; and corporate value recovery through enhanced shareholder returns." He added, "Major momentum will concentrate around early April, and the clarification of tariff policies will be a turning point for stock prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.