Major Fashion Companies See Negative Growth

Consumers Shift to Cost-Effective Clothing Amid Economic Downturn

SPA Brands Achieve Record-Breaking Performance

Last year, the fashion industry collectively received disappointing performance results. Due to the economic downturn, consumers were reluctant to open their wallets easily, and the warm weather during the winter season?considered the peak season for the fashion industry?led to postponed purchases of high-priced clothing such as padded jackets. However, affordable SPA brands attracted buyers by offering low prices and trendy designs.

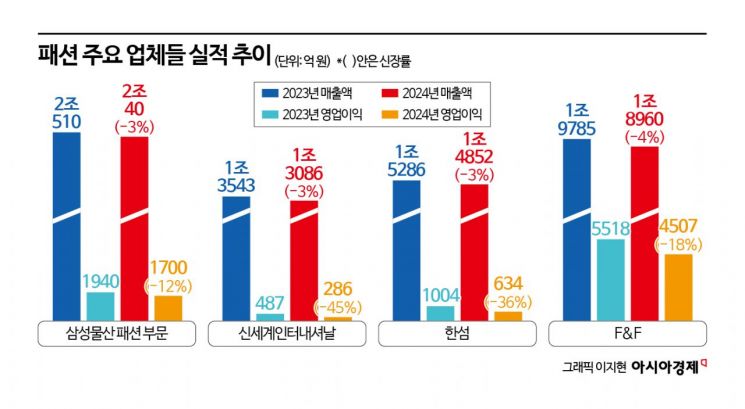

According to the fashion industry on the 14th, the performance of four fashion companies (Samsung C&T Fashion, Shinsegae International, Handsome, and F&F) all showed a decline compared to the previous year. Both sales and operating profits decreased. Samsung C&T’s fashion division was the only one to maintain sales in the 2 trillion KRW range, but its operating profit fell by about 20 billion KRW from the previous year to 170 billion KRW, a drop of approximately 12%.

The decline in performance was even greater for Shinsegae International and Handsome. Shinsegae International’s operating profit last year was 28.6 billion KRW, cutting its profit in half compared to the previous year, while Handsome’s operating profit was 63.4 billion KRW, failing to maintain profitability in the 100 billion KRW range. The worsening performance in the fourth quarter, considered the peak season for the fashion industry due to strong sales of high-priced products, contributed to the annual decline. An increase in accounting costs (retirement allowance liabilities) due to the ruling on ordinary wages also played a role. Handsome’s fourth-quarter sales were 435.7 billion KRW, and operating profit was 20.9 billion KRW, down 3% and 37% respectively compared to the fourth quarter of 2023. Shinsegae International’s sales decreased by 3% to 382.3 billion KRW during the same period, and operating profit plummeted by 98% to 300 million KRW.

The fashion industry cites 'abnormal weather' and 'domestic demand slump' as the main reasons for the poor performance. Temperature directly affects clothing consumption. Last year, the autumn and early winter weather was warmer than expected, causing mid-season clothing, outerwear, and coats?high-priced items?not to sell on time. Although demand for outerwear increased after the cold set in from December, winter new products became leftover stock, leading fashion companies to sell them at discounted prices.

The economic downturn last year also froze the domestic market, worsening year-end consumption. According to Statistics Korea’s ‘December 2024 and Annual Industrial Activity Trends,’ the retail sales index fell by 2.2% compared to the previous year, the largest decline since the 2003 credit card crisis (-3.2%). This was mainly due to a 3.7% decrease in semi-durable goods such as clothing and footwear. Clothing and footwear are items consumers cut back on first when the economy is weak.

On the other hand, SPA (Specialty store retailer of Private label Apparel) brands producing cost-effective clothing recorded their highest-ever performance. The fact that consumers could purchase trendy clothing at lower prices compared to brands operated by large fashion companies opened wallets. SPAO recorded sales of 600 billion KRW last year, an increase of 200 billion KRW over two years from 400 billion KRW in 2022. Topten recorded sales in the high 900 billion KRW range, nearing entry into the 1 trillion KRW club. Fashion platform Abley reported that the transaction volume of SPA brands such as Zara, Uniqlo, 8Seconds, and Giordano doubled in the fourth quarter last year. In particular, outerwear sales surged by 227% during the same period.

A customer shopping at The Shoppers on the 4th floor of the main building of Shinsegae Department Store. Provided by Shinsegae Department Store.

A customer shopping at The Shoppers on the 4th floor of the main building of Shinsegae Department Store. Provided by Shinsegae Department Store.

The fashion industry is preparing a foothold for a rebound to escape the sluggish performance. Although the business environment is expected to remain challenging this year due to the economic downturn and high exchange rates, companies are entering a rigorous emergency management phase by controlling costs and strengthening profitability.

Samsung C&T Fashion is focusing on strengthening the fundamentals of its operating brands. Demand for new luxury brands such as 'Issey Miyake' and 'Lemaire' is strong, and the company plans to gradually increase their supply. 'Jacquemus' and 'CDG3' will expand premium retail stores to develop them into flagship brands. The competitiveness of in-house brands such as Beanpole, 8Seconds, and Kuho will be enhanced, with plans to enter overseas markets including China and Southeast Asia. Additionally, the company is considering new ventures into the lifestyle sector.

Shinsegae International has established an emergency management plan and is focusing all efforts on securing profitability. To strengthen the competitiveness of its in-house brands, it is currently rebranding three brands: 'Studio Tomboy,' 'J. Cut,' and 'Bov.' The plan is to transform them with concepts that align with new fashion trends. A company representative explained, "In the beauty sector, we will focus on globalizing our in-house brands (Swiss Perfection, Yeonjak, BDB), and plan to expand sales channels overseas by entering online stores in Japan, China, and Southeast Asia."

F&F is raising expectations for a recovery in Chinese consumption. Having secured the Discovery brand rights in major Asian countries, F&F plans to increase the number of Discovery stores in China from the current five to 100 by this year. As a brand strong in winter outerwear, Discovery’s sales in China are expected to grow rapidly in the second half of the year. The expanding optimism about the Chinese government’s economic stimulus measures is also positive.

Handsome plans to reduce costs by optimizing inventory management. It will actively target the European market through brands such as 'System' and 'Time.' To secure new sales channels, it will also launch color cosmetics.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![15-Year Veteran Field Mechanic Becomes AI Talent... Korean Air's Experiment [AI Era, Jobs Are Changing]](https://cwcontent.asiae.co.kr/asiaresize/319/2025121111232252273_1765419802.jpg)