Hana Financial, Fink Records 7 Consecutive Years of Losses

JB Financial, Strategic Investment in Finda for 2 Consecutive Years

Plans to Respond with New Product Launches, but Insufficient

Fintech (finance + technology) companies invested in or owned by financially strong financial firms recorded losses again last year. This is because the market situation was challenging, with investment volumes themselves decreasing. Companies are preparing self-help measures by launching innovative products within limited business areas. However, the industry believes that long-term plans from authorities are more important than temporary regulatory relaxations such as the designation of innovative financial services.

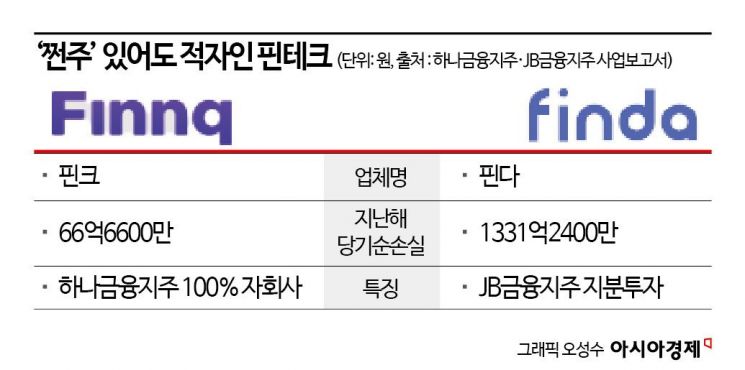

According to the business report of Hana Financial Group on the 26th, its subsidiary Fink recorded a net loss of 6.966 billion KRW last year. Although this is about half of the 12.38 billion KRW loss in 2022, it marked the seventh consecutive year of losses. Fink, which mainly operates financial product brokerage services, was established in 2016 through investment by Hana Financial Group and SK Telecom. Later, in 2022, Hana Financial Group acquired the shares and incorporated it as a subsidiary.

The situation is similar for fintech companies strategically invested in by financial holding companies. In July last year, Finda received an investment of 47 billion KRW from JB Financial Group. At that time, Finda’s cumulative investment was 64.4 billion KRW, with JB Financial Group’s investment accounting for about 73% of the total investment. Finda recorded a net loss of 133.124 billion KRW last year. Although sales decreased due to a decline in new loan transactions last year, Finda explained that losses were minimized as expenses such as labor costs also decreased.

One reason fintech companies could not avoid losses despite large-scale investments is that the investment volume itself is shrinking. The bankruptcy of Silicon Valley Bank last year and other factors inevitably dampened investment sentiment toward fintech, which also affected domestic fintech investments.

According to the ‘2023 Inside Fintech’ report jointly published by Seoul Fintech Lab and Innovation Forest, domestic fintech investment amounted to 1.369 trillion KRW up to the third quarter of last year. This is a decrease of more than 50% compared to 2.91 trillion KRW in 2022. The number of investment deals also dropped from 168 in 2022 to 91 as of the third quarter last year. Even assuming 30 investments per quarter, the total remains around 120 deals. A financial sector official said, “Since startups typically maintain losses for a long time, continuous investment is necessary,” adding, “With the reduction in investment volume, it is difficult to boldly pursue new businesses or business expansion.”

Fintech companies plan to first reduce the scale of losses by launching new products within regulatory limits. If external investment is difficult, they aim to enhance their own competitiveness to attract sales. Fink announced that it will launch digital seal certification and virtual asset wallets that do not require secret key storage this year. A Hana Financial Group official said, “Among the various new services to be introduced by Fink, at least one is expected to establish itself in the market, and we anticipate a turnaround to profitability around 2026.” Finda plans to introduce new forms of remittance and transfer services through obtaining a comprehensive financial business license.

The market situation is expected to improve this year. This is because the government has begun easing regulations related to fintech. The Ministry of Economy and Finance recently expanded the number of foreign exchange service sectors that fintech can operate from three to five in its ‘Regulatory Innovation Plan for New Industries.’ Measures to revitalize fintech investment were also included. Regulations were relaxed to allow large financial firms to exercise voting rights when holding shares of fintech companies classified as non-financial businesses. Financial authorities such as the Financial Services Commission and the Financial Supervisory Service have also held ‘visiting financial regulatory sandbox’ meetings this year to listen to difficulties and discover new demands for the designation of innovative financial services.

As regulations are eased, companies will have opportunities to enter various businesses and launch innovative products in the market. If these products are recognized for their innovation, a ‘virtuous cycle’ structure can be created where investors such as venture capitalists (VCs) can invest in fintech.

Therefore, there are calls for more bold regulatory ‘innovation.’ A fintech company official said that the absence of a basic law regulating fintech creates high market uncertainty, stating, “Companies find it difficult to boldly expand their businesses, and investment firms inevitably hesitate to invest.” He added, “Instead of temporarily easing regulations through the designation of innovative financial services, continuous policies and institutional improvements are urgently needed.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.