Average Daily New Customers This Year Exceed Three Times Last Year's Number

K Bank has surpassed 10 million customers. It is continuing rapid growth ahead of its initial public offering (IPO), marking an achievement about seven years after its launch in April 2017.

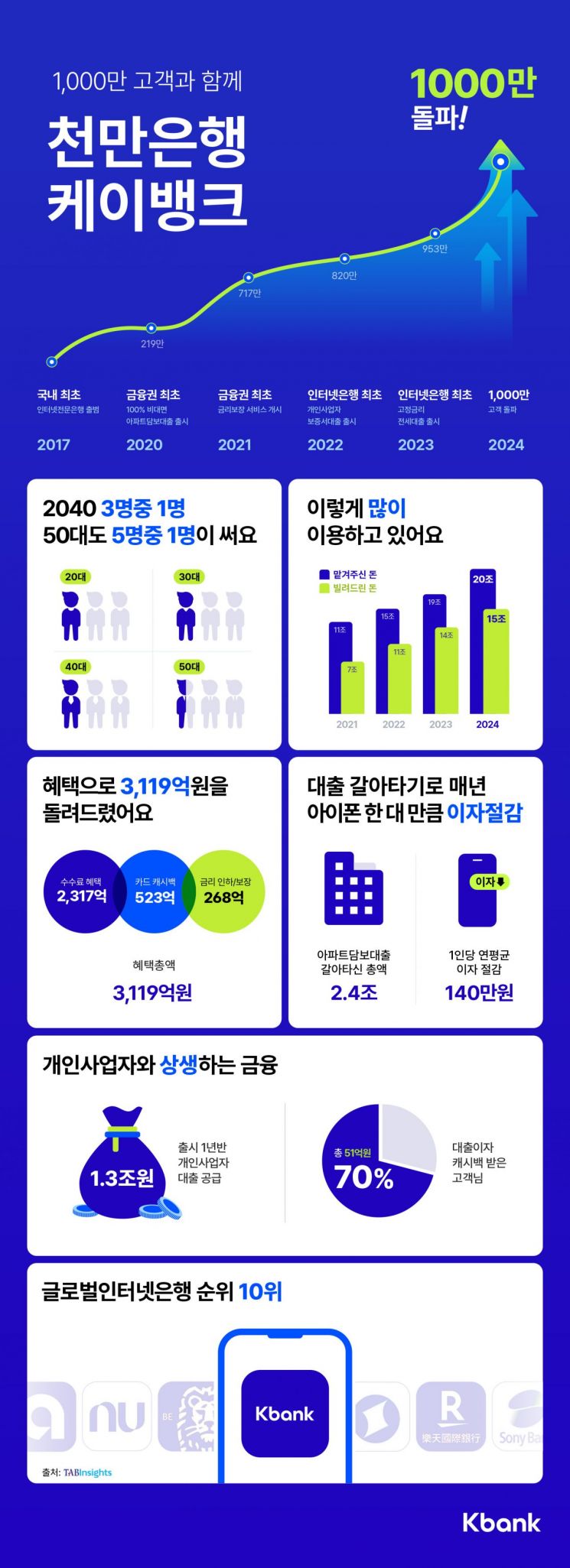

K Bank announced on the 26th that its customer base exceeded 10 million. The number steadily increased from 7.17 million at the end of 2021, 8.2 million at the end of 2022, to 9.53 million at the end of last year. Especially this year, the average daily new customers have grown more than three times compared to last year. During this period, K Bank recorded deposit balances of 21 trillion won and loan balances of 15 trillion won.

Analyzing the 10 million customers by age group, one out of three people in their 20s to 40s in Korea uses K Bank. Among those in their 50s, one out of five is a customer. Among the customers newly joined since last year, about 30% are aged 60 and above or under 10.

K Bank’s ability to secure 10 million customers is influenced by its interest rate competitiveness and benefits, convenient user interface (UI) and user experience (UX) based on tech leadership, and the provision of diverse investment opportunities.

An example demonstrating K Bank’s interest rate competitiveness is the launch of Korea’s first non-face-to-face apartment mortgage loan. Since its release in August 2020, about 12,000 customers have saved a total of 16.6 billion won in interest. The average annual interest savings per person is 1.4 million won, which K Bank explains is equivalent to receiving a free Apple iPhone every year.

K Bank has also led financial innovation by leveraging new technologies such as artificial intelligence (AI) and big data. A representative example is the introduction of the ‘Immediate Release of Account Freeze System,’ the first in the financial sector. When a customer whose account has been frozen due to a payment suspension files an objection, AI and big data analyze financial transaction patterns; if the case is deemed unjust, the account freeze is lifted excluding the reported financial transactions. Other innovations include technology to detect ID forgery and alteration, ‘Our Home Change Notification,’ and the transition of big data systems to the cloud.

Through its application (app), K Bank offers investment opportunities in various assets ranging from listed stocks, public offerings, virtual assets, to fractional investment in artworks. It supports account opening with five domestic securities firms including NH Investment & Securities and Mirae Asset Securities, allowing users to directly trade stocks.

K Bank plans to grow beyond a 10 million customer bank to become the leader in internet banking by securing customer trust, driving financial innovation through technology, and practicing inclusive finance. Choi Woo-hyung, CEO of K Bank, said, “Achieving 10 million customers is the result of customers recognizing our remarkable benefits, innovative products and services, and convenient usage environment,” adding, “We will strengthen both scale and substance to become a bank that customers trust and a bank that innovates customers’ financial experiences.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.