Delisted from KOSDAQ in 2016

Attempted IPO in 2021 but 'Not Approved'

COVID-19 Accounts for 80% of Total Sales 'Weakness'

Osang Healthcare (formerly Infopia), which was delisted from the KOSDAQ market, is making a second attempt at an initial public offering (IPO). Osang Healthcare previously tried to list on KOSDAQ in 2021 under the special exception for unprofitable companies but failed.

According to the Financial Supervisory Service's electronic disclosure system on the 17th, Osang Healthcare plans to raise 990,000 new shares for listing on the KOSDAQ market.

Osang Healthcare's predecessor is Infopia. Infopia is a company engaged in the manufacturing of medical devices and pharmaceuticals, established on April 26, 1996. It entered the KOSDAQ market in 2007. In February 2016, Infopia became subject to a substantial review of listing eligibility due to charges of embezzlement and breach of trust. In March, it was delisted after a disclaimer of opinion was issued on its 2015 financial statements. Despite Osang Group acquiring Infopia and becoming the largest shareholder at that time, the company was ultimately expelled from the KOSDAQ market.

The delisted Infopia changed its name to Osang Healthcare and reorganized its business. In 2021, it sought to re-enter KOSDAQ through the special exception for unprofitable companies, known as the Tesla listing, but failed after receiving a non-approval notice from the Korea Exchange. The past delisting history and uncertainties regarding performance continuity influenced this outcome.

Subsequently, Osang Healthcare achieved performance growth. The COVID-19 pandemic acted as a catalyst for diagnostic reagents. Osang Healthcare developed a COVID-19 molecular diagnostic reagent in 2020. This reagent was the first domestic product to receive emergency use authorization from the U.S. Food and Drug Administration (FDA). The immune diagnostic (self-test) kit developed afterward also obtained FDA emergency use approval.

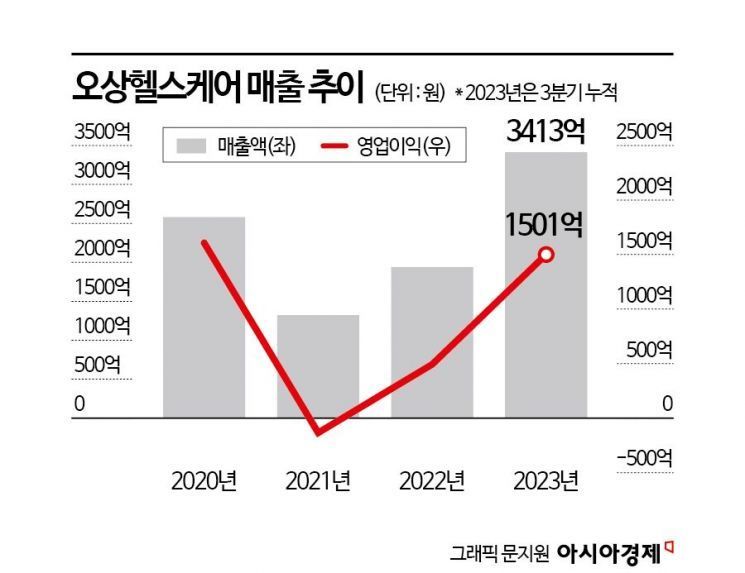

On a consolidated basis, Osang Healthcare's performance jumped from KRW 57.3 billion in sales and an operating loss of KRW 1.5 billion in 2019 to KRW 258 billion in sales and an operating profit of KRW 160.7 billion in 2020 due to COVID-19. In 2022, it recorded sales of KRW 193.9 billion and an operating profit of KRW 49.3 billion. As of the cumulative third quarter of last year, sales and operating profit reached KRW 341.3 billion and KRW 150.1 billion, respectively, marking increases of 130.18% and 204.38% compared to the same period the previous year.

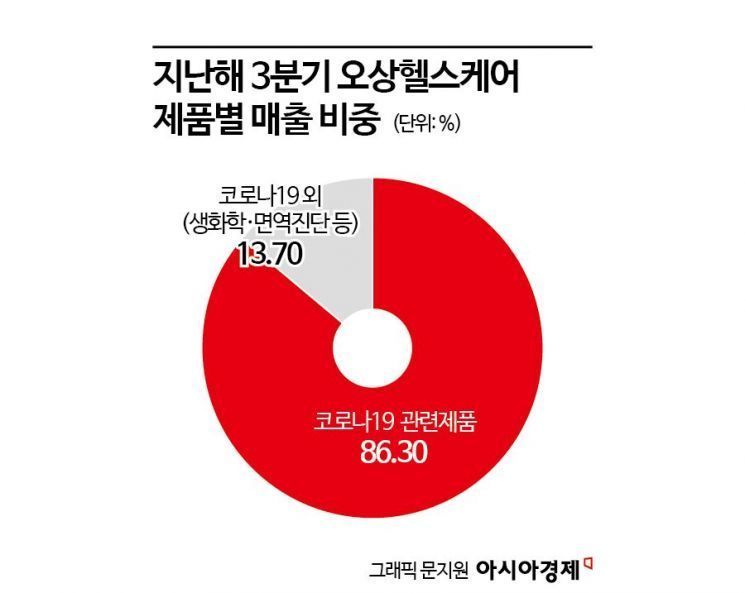

However, the sales concentration on COVID-19 products is a weakness. As of the third quarter of last year, COVID-19-related products accounted for 86.30% of total sales. The company also explained in its securities registration statement that "financial performance increased sharply depending on the COVID-19 situation" and "the current high financial growth rate may decrease as the COVID-19 situation ends."

Osang Healthcare's expected public offering price range is KRW 13,000 to KRW 15,000 per share. The offering size is KRW 12.9 billion to KRW 14.9 billion, and the expected market capitalization after listing is KRW 183.4 billion to KRW 211.6 billion. When setting the desired offering price, the lead underwriter NH Investment & Securities selected eight comparable companies: LabGenomics, Boditech Med, Bionote, Sugentech, Seegene, i-SENS, SD Biosensor, and Humasis. Applying an average price-to-book ratio (PBR) of 1.20 from these companies, Osang Healthcare's average per-share value is KRW 24,954. A discount rate of 39.89% to 47.91% was applied to present the current desired offering price.

Osang Healthcare plans to use the funds raised from the KOSDAQ listing for research and development (R&D), overseas market expansion, and production facility expansion. It will invest KRW 2.5 billion in R&D, including purchasing research equipment and hiring personnel. Additionally, KRW 2.1 billion will be used for clinical trials and regulatory approvals to support overseas expansion. Furthermore, KRW 8 billion will be allocated to replace aging production facilities and expand new equipment.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.