KOSDAQ Market Begins Full Decline from September

Early Redemption Period Approaches for Convertible Bonds Issued in 2021

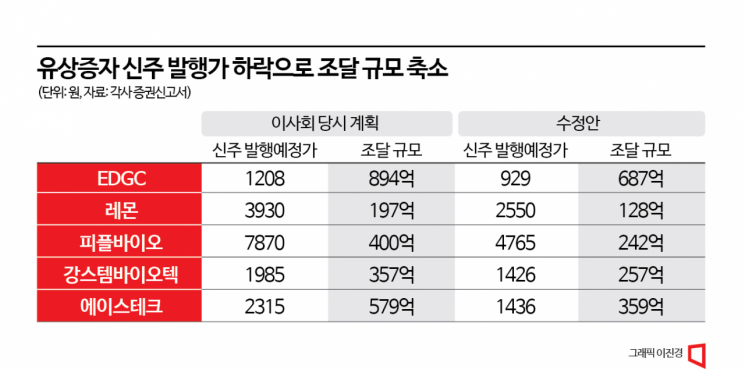

Reduced Capital Increase Scale Causes Setbacks in Debt Repayment and Investment Plans

As the preference for safe assets over risky assets grows, the KOSDAQ market continues to underperform. Listed companies urgently needing to improve their financial structure ahead of external audits are struggling to raise funds. Despite risking shareholder value dilution by proceeding with rights offerings, the scale of fundraising has decreased due to continued stock price declines. Early redemption requests for previously issued convertible bonds are also increasing, raising concerns about potential defaults.

According to the Korea Exchange on the 17th, the KOSDAQ index has fallen 12.7% compared to the end of August. The index, which had been above the 900 level, briefly dropped below 800 during trading on the 10th. This contrasts with the first half of this year when the index rose about 40% from 600 to 900, led by secondary battery-related stocks.

Foreign investors, who had been net buyers in the domestic stock market since the second half of last year, have been net sellers since last month. Yeom Dong-chan, a researcher at Korea Investment & Securities, explained, "One of the main reasons for foreign selling is the strength of the US dollar," adding, "We also need to consider the possibility that third-quarter earnings may fall short of market expectations."

As third-quarter earnings reports begin to be released, profit-taking sales of secondary battery, artificial intelligence (AI), and robotics-related stocks are pouring in, adding to market pressure. Ecopro and Ecopro BM, which led the KOSDAQ market's rise in the first half of this year, reported third-quarter earnings below expectations on the 13th. Although expectations for the secondary battery industry had risen, the slower-than-expected profit growth has weakened investment sentiment toward growth stocks overall. Moreover, geopolitical factors such as the Israel-Palestine conflict have strengthened the preference for safe assets.

Due to the KOSDAQ market's sluggishness, listed companies pursuing rights offerings are facing difficulties in raising funds. Many have reduced their fundraising targets and revised debt repayment and investment plans. Some companies worry that disruptions in financial restructuring efforts may prevent them from receiving a 'fair' audit opinion.

Genomic analysis company EDGC is conducting a rights offering to raise operating funds and debt repayment capital. At the board meeting on August 18, the anticipated new share price was 1,208 KRW, but the final issue price was lowered to 929 KRW. The fundraising target also decreased from 89.4 billion KRW to 68.7 billion KRW, reflecting a 40% drop in EDGC's stock price over two months.

With existing shareholders' subscription scheduled from the 19th to the 20th, the stock price fell to 930 KRW the day before. The decline to the new share issue price level has cast a red light on subscription enthusiasm. If unsubscribed shares occur in the existing shareholders' subscription, a general public offering subscription will be held for two days starting on the 24th. Since the lead manager KB Securities did not sign a standby underwriting agreement, any unsubscribed shares in the general public offering will be canceled.

EDGC revised its fund usage plan after finalizing the new share issue price. With the expected fundraising amount reduced by over 20 billion KRW, plans for research and development (R&D) budgets, global marketing expenses, and general administrative costs were scaled back. The plan to allocate 36.5 billion KRW for debt repayment was maintained. This considers the early redemption payment date for convertible bonds issued in October and December 2021, which falls in the fourth quarter of this year. The company believes there is a high possibility of early redemption requests since the current stock price is below the conversion price. The outstanding convertible bond balance is 36.5 billion KRW.

If the funds raised through the rights offering are insufficient, discussions on extending loan repayments or payment deferrals may be necessary. EDGC recorded sales of 51.8 billion KRW and an operating loss of 4.9 billion KRW in the first half of this year.

Not only EDGC but also companies like PeopleBio and Lemon, which recently completed rights offerings for existing shareholders, have seen their fundraising scales shrink compared to initial plans. Lemon planned to raise 19.7 billion KRW by issuing 5 million new shares at 3,930 KRW per share on July 20. The initial planned issue price was lowered to 3,215 KRW and finally fixed at 2,550 KRW. There were 610,000 unsubscribed shares in the existing shareholders' subscription. These unsubscribed shares will be offered to investors through a general public offering subscription.

PeopleBio also recorded a 90% subscription rate from existing shareholders. The new share issue price dropped 40% from the plan, reducing the fundraising scale and resulting in unsubscribed shares.

Both Lemon and PeopleBio revised their operating fund plans due to the reduced fundraising scale from the rights offerings. They maintained their planned debt repayment amounts. Lemon will use 3.1 billion KRW of the raised funds for debt repayment and the remainder for operating expenses. At the time of the board resolution, the operating fund budget was set at 16.1 billion KRW but was reduced to 9.4 billion KRW after finalizing the issue price. PeopleBio will use 17.5 billion KRW for debt repayment and the rest to expand domestic channels and overseas entry for its early Alzheimer's disease diagnostic kit. PeopleBio is preparing for early redemption requests on convertible bonds issued in 2021, anticipating that investors will request early redemption as the stock price fell below the conversion price.

An investment banking (IB) industry official explained, "Listed companies facing early redemption payment dates for convertible bonds issued in 2021 are experiencing financial difficulties," adding, "With external audits approaching, they must improve their financial structures, but there are limited options for raising funds."

A company official said, "Rising benchmark interest rates have made fundraising more difficult," adding, "With tightened regulations, the private placement market for convertible bonds has also shrunk, leaving many listed companies with no choice but rights offerings." He continued, "Even if companies try to issue convertible bonds privately, regulations are strict and major investors have decreased," expressing concern that "many listed companies may fail to receive fair audit opinions."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![$29 Monthly Subscription AI Plant Appliance... US Startup Challenges LG [CES 2026]](https://cwcontent.asiae.co.kr/asiaresize/319/2026010819285284553_1767868133.png)