Top 4 Firms Samil, Samjung, Han Young, Anjin See Highest Revenue but Profit Decline

M&A and Consulting Demand Plunge... Average Labor Costs Up 13%

The top four domestic accounting firms (Samil, Samjong, Hanyoung, Anjin) are struggling with a sharp decline in profits. Although sales increased, profits decreased, resulting in unprofitable business. Due to poor corporate performance, demand for management consulting and advisory services declined, while labor costs rose, increasing expenses. The bigger problem is that next year's performance outlook is even bleaker than this year. With growing concerns about an economic recession, the dominant view is that the 'Big 4' accounting firms' profits will shrink further next year. Additionally, there are growing concerns that the performance of small and medium-sized firms will deteriorate, leading to a harsh winter across the accounting industry.

According to the Financial Supervisory Service and the accounting industry on the 16th, the total revenue of the domestic Big 4 accounting firms for the 2022 fiscal year (July 1, 2022 ? June 31, 2023), including separate consulting divisions and subsidiaries, reached 3.6247 trillion KRW. This is a record high. The combined sales of the four firms increased by 13.7% from the previous year (3.188 trillion KRW), which was the first time the total exceeded 3 trillion KRW. This increase is attributed to growth in accounting audit and tax advisory revenues. The average growth rate of audit revenue among the Big 4 was 15.9%, and tax advisory revenue grew by 13.7%. The surge in audit demand, a major segment for accounting firms, following the implementation of the new External Audit Act in 2019, is cited as the reason for the increase in audit revenue.

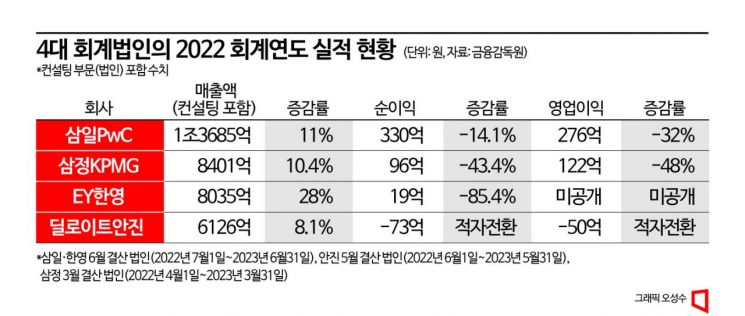

Samil PwC, the top accounting firm with a June fiscal year-end that disclosed its results last month, recorded revenue of 1.3685 trillion KRW, an 11% increase from the previous year. Samjong KPMG, the second-ranked firm with a March fiscal year-end, posted revenue of 840.1 billion KRW, up 10.4%. EY Hanyoung, ranked third and reporting results in September with a June fiscal year-end, showed even steeper growth. Its revenue rose 27.9% year-on-year to 803.5 billion KRW. Deloitte Anjin, ranked fourth with a May fiscal year-end, recorded revenue of 612.6 billion KRW, an 8.1% increase.

Although all four major accounting firms achieved higher revenue growth rates compared to the previous year, the gains were hollow. Operating profit and net income declined. For the 2022 fiscal year, the Big 4's net income was 37.2 billion KRW, down 54.6% from 82 billion KRW the previous year. Samil PwC's net income decreased by 14.1% to 33 billion KRW, Samjong KPMG's fell 43.4% to 9.6 billion KRW, and EY Hanyoung's plunged 85.4% to 1.9 billion KRW. Deloitte Anjin turned to a loss.

The decline in operating profit was also significant. Samil PwC's operating profit dropped 32% from 40.7 billion KRW to about 27.6 billion KRW. Samjong KPMG's operating profit fell 48% to 12.2 billion KRW. EY Hanyoung did not disclose operating profit, but excluding the consulting division, Hanyoung Accounting Firm's operating profit decreased from 17.8 billion KRW to 17.3 billion KRW, suggesting a decline. Deloitte Anjin posted a loss of 5 billion KRW this year.

This profit deterioration is due to a decrease in work such as management consulting and advisory services, while labor costs surged. The labor costs of the Big 4 accounting firms in the 2022 fiscal year increased by an average of 13% compared to the previous year. However, demand for M&A advisory and consulting services sharply declined. Since the second half of last year, the economy has been in a downturn, worsening the business environment for companies. The number and scale of M&A deals have shrunk. The private equity fund (PEF) operators, major players in the domestic M&A market, have refrained from participating, affecting deal volume. PEF operators maximize returns through leveraged buyouts (LBO) using acquisition financing (loans for M&A), but high interest rates have made it difficult to secure acquisition financing. Experts believe that with acquisition financing rates holding at 7-8% amid ongoing high interest rates, recovery in the M&A market will be difficult.

Profitability indicators in the accounting industry are expected to worsen further in the 2023 fiscal year. A senior official from one accounting firm said, "Corporate business activities are contracting, and sales from M&A and consulting divisions continue to decline," adding, "Next year, even external growth will be hard to guarantee." Another senior official from a different accounting firm said, "We need to see if the M&A market will revive next year," and added, "There will be fierce efforts to discover new revenue sources to improve profitability in the accounting industry."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.