'Third-Party Fraud' with Different Buyer and Depositor

Severe Damage as Goods Are Lost and Bank Transactions Are Suspended

There was a case where a person suffered financial transaction paralysis after being falsely accused of voice phishing despite conducting a legitimate transaction through a secondhand trading platform. This was due to a so-called 'third-party fraud,' where the buyer of the item and the account depositor were different individuals.

According to a report by Yonhap News on the 9th, Mr. A, who lives in Seoul, sold a gold necklace to Mr. B through the secondhand trading platform Danggeun Market on the 29th of last month. After confirming that the money had been deposited into his bank account, Mr. A handed over the necklace to Mr. B, who came to his house.

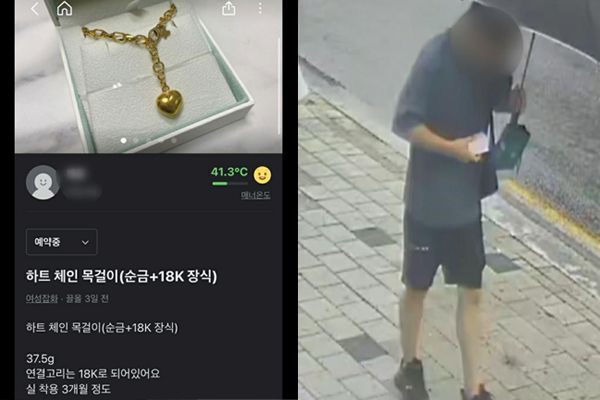

Gold necklace used in third-party fraud on a secondhand trading platform [Photo by informant Mr. A, Yonhap News]

Gold necklace used in third-party fraud on a secondhand trading platform [Photo by informant Mr. A, Yonhap News]

What seemed like a normal transaction that day later led to serious problems. Twenty minutes after the secondhand transaction, Mr. A received a call from the bank suspecting fraud, and at 6 p.m. on the same day, he was notified that his account had been reported for use in voice phishing, resulting in the suspension of all deposits and withdrawals from all his accounts.

It turned out that the person who transferred money to Mr. A's account was not Mr. B, who took the necklace, but a third party, Mr. C. Mr. C had agreed to receive the gold necklace from Mr. B and sent the money, but when he did not receive the item, he reported it as fraud. Since Mr. B gave Mr. C Mr. A's account number and then disappeared, a dispute arose between Mr. A and Mr. C, who had no prior acquaintance, resulting in a 'third-party fraud.'

Under current law, for Mr. A to resume financial transactions, he must return the money to Mr. C, putting him in a situation where he loses both the necklace and the money. Mr. A visited the police station out of frustration but was told that since the money was deposited into his account, he was considered a fraud suspect and had not suffered financial damage, so a criminal complaint could not proceed. When he visited the bank, he was told that he could only resume financial transactions if he proved the transaction was not fraudulent or if Mr. C withdrew the complaint. Moreover, since Mr. A was a suspect, it was difficult for him to contact Mr. C first, and any settlement would require Mr. C to initiate contact.

Mr. A reported his case to the Financial Supervisory Service. Needing to receive his salary and pay living expenses through bank transactions immediately, he submitted his police statement to the bank and requested police cooperation to secure CCTV footage from security cameras that likely captured Mr. B during the secondhand transaction. On the afternoon of the 7th, after Mr. C filed a report with the police and Mr. A's victim status was clarified, the bank account was reopened, but Mr. A had already suffered severe mental and physical distress for ten days.

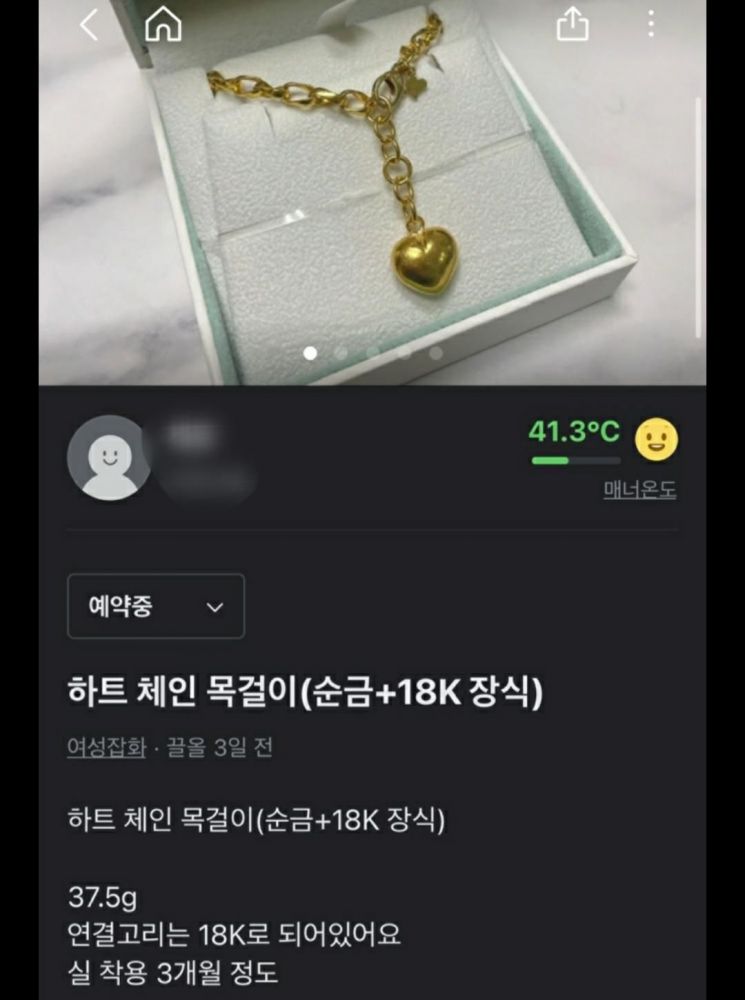

The image of the used goods scammer who took Mr. A's gold necklace and ran away on the 29th of last month [Photo by Mr. A, provided by the informant, Yonhap News]

The image of the used goods scammer who took Mr. A's gold necklace and ran away on the 29th of last month [Photo by Mr. A, provided by the informant, Yonhap News]

Mr. A told Yonhap News, "I could have lost both the necklace and the money after the secondhand transaction, and my financial transactions were paralyzed immediately, yet it was difficult to get relief. I believe there is a flaw in the current law." He added, "If 'third-party fraud' is organized systematically, one could lose the item and be extorted for a settlement fee as a condition for resuming financial transactions."

The 'third-party fraud' experienced by Mr. A is not the first case, and caution is required among secondhand traders. In June, a delivery worker who delivered coffee and bread and received payment via bank transfer was falsely accused of voice phishing, resulting in the suspension of financial transactions. Experts believe this is likely a 'bankbook scam' method, where after a small deposit is made by another person, the account is suspended due to a voice phishing suspicion report, and then a settlement fee is demanded under the pretext of lifting the suspension.

Also, in December last year, a seller who sold a pure gold bracelet for 6.43 million won on a secondhand trading site experienced the same issue as Mr. A. To prevent such damage, it is safer to conduct cash transactions whenever possible in secondhand trading.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.