Major Business Hotels Expand Branches During COVID Period

Active 'Premiumization' Breaking Business Hotel Stereotypes

Occupancy Rates Significantly Rise with the Endemic

Brand business hotels claiming to be "4.5-star" are gaining attention in the market. While many hotels collapsed due to the impact of COVID-19, these hotels not only endured thanks to the financial strength of their groups or chains but also expanded their presence and redefined a premium strategy that goes beyond the limitations of business hotels, preparing for the endemic (periodic outbreak of infectious diseases).

From the left, Shilla Stay Yeosu, Nine Tree Premier Hotel Insadong, Best Western Sokcho view.

From the left, Shilla Stay Yeosu, Nine Tree Premier Hotel Insadong, Best Western Sokcho view. [Photo by each company]

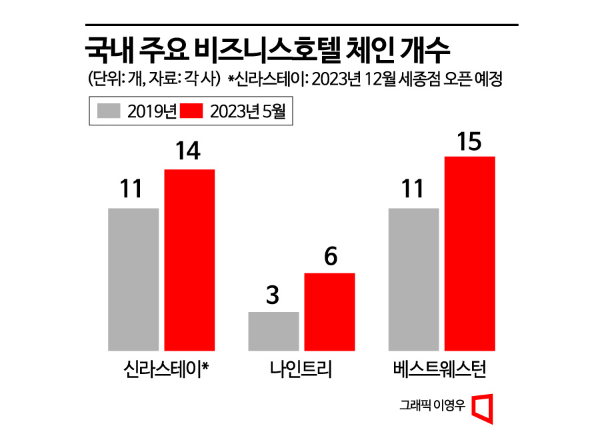

According to the hotel industry on the 14th, major domestic brand business hotels opened additional hotels in key regions nationwide during the COVID-19 period, actually increasing their numbers. Nine Tree Hotel, a business hotel brand operated by Parnas Hotel, doubled its locations from 3 in 2019, just before COVID-19, to 6 currently by opening new hotels in Dongdaemun in 2020, Pangyo in 2021, and Yongsan this year. Shilla Stay, the business hotel brand of Hotel Shilla, also expanded from 11 locations before COVID-19 to 14 by opening three additional hotels in Samsung in 2020, and West Busan and Yeosu in 2021. Best Western, the world's largest hotel chain, increased its number of hotels from 11 nationwide in 2019 to 15 this year. Chosun Hotel & Resort also opened its business hotels, Four Points by Sheraton Myeongdong and Gravity Pangyo, as planned in 2020. Hanwha Hotels & Resorts opened Martie Osiria last year, despite the ongoing impact of COVID-19.

The hotels opened during the COVID-19 period were designed as premium business hotels reflecting recent trends preferred by domestic and international guests, featuring clean and sophisticated interiors, food and beverage (F&B) options such as breakfast, swimming pools, and jacuzzis. While business hotels traditionally targeted business customers visiting for work or short-distance tourists from China and Japan, focusing on accommodation itself mainly in key city areas, recently they have been operated as 4.5-star hotels with photo-worthy spots and entertainment for friends, couples, and family staycation customers, also offering family rooms. This strategy proved successful during the COVID-19 period. Even as international tourist and business demand, the core customer base, sharply declined due to closed air routes, domestic staycation customers continued to visit mainly around weekends and holidays, allowing operations to continue.

Recently, they have been enjoying a boom regardless of weekdays or weekends due to the surge in foreign demand after the endemic. Tourists and business customers seeking efficiency are flocking to these hotels, which offer premium facilities and services at reasonable prices compared to 5-star hotels. The solid banquet facilities prepared for global conferences and seminars have also been helpful. The average occupancy rate of Shilla Stay’s 14 branches from January to May this year exceeded 80%. Nine Tree’s average occupancy rate in the first quarter of this year reached 82.4%. A Nine Tree representative said, "Since the beginning of this year until this month, weekends have been almost fully booked, and weekday occupancy rates have consistently recorded over 80%. The proportion of foreign guests has increased nearly sixfold compared to the same period last year, exceeding 90%." Four Points Myeongdong currently has a foreign guest ratio of 97-98%.

The hotel industry expects the rise of brand business hotels to continue for the time being due to rapidly changing domestic and international customer trends and diversification of hotel chain strategies after the pandemic. Best Western plans to expand its luxury brands, including the Premium Collection and Signature Collection, which were newly opened during the COVID-19 period. Hanwha Hotels & Resorts also plans to introduce more than 10 Martie brand locations nationwide by 2030. Professor Yoon Tae-hwan of the Department of Hotel Convention Management at Dong-Eui University said, "The recent trend in business hotels is to specialize and strengthen facilities and services popular with domestic and international MZ generation (Millennials + Gen Z) guests, such as swimming pools and fitness centers. Even without providing full services like luxury hotels, this trend of offering some premium services targeting specific customer segments is expected to continue."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.