Raised 1 Trillion Won in Just 4 Days After Launch

WSJ "Transfer Completed After 3 Weeks"

Security Issues and Technical Errors Cited

Apple Savings Account, which raised 1 trillion won within four days of its launch, has faced transfer delays in less than two months since its release. Apple has not provided a clear response regarding the delay, while security issues related to large transfers and technical errors are being cited as reasons for the transfer delays. Customers who trusted Apple, which had promised financial innovation, are left frustrated.

On the 1st (local time), The Wall Street Journal (WSJ) reported that some customers are experiencing difficulties due to delays in transferring deposits from Apple accounts to other banks.

According to WSJ, a customer living in Atlanta tried to transfer $1,700 from an Apple Savings Account to a JP Morgan Chase bank account on the 15th of last month, but only confirmed the transfer was completed on the 1st of this month. The customer complained, "I repeatedly called the customer service department of Goldman Sachs, Apple's Savings Account partner, but every time I called the responsible department, they kept asking me to wait a few more days."

Another customer, who deposited $100,000 in an Apple Savings Account, tried to transfer the funds to another bank in January last month. However, WSJ reported that the transfer took more than three weeks. Although the customer completed the transfer to the other bank, they experienced the bizarre situation where the balance of the receiving account was displayed as "$0." Goldman Sachs later informed this customer that the account was undergoing a security review.

A customer residing in Minnesota also tried to transfer funds to US Bank, but Goldman Sachs delayed the transfer by reviewing security issues related to the savings account. Eventually, the customer told WSJ that they had to sell $12,000 worth of stocks to raise cash.

Although complaints about transfer delays have erupted from various places, the exact cause of the delay has not yet been revealed. Some have diagnosed that the problem arose due to anti-money laundering systems. An anti-money laundering industry official told WSJ, "If a significant portion of deposits is transferred to a specific bank, anti-money laundering alerts or other security issues may arise, causing deposit transfer delays." Such problems often occur when customers transfer large amounts from newly opened savings accounts to other banks.

However, even considering these security issues, experts point out that delays lasting several weeks are unprecedented. Dennis Rodel, a U.S. financial crime research expert and banking consultant, told WSJ, "It is reasonable for banks to delay transfers to strengthen security, but delays of two to four weeks are definitely long and unreasonable." An anti-money laundering industry official also explained, "Such delays usually last about five days."

WSJ inquired with Apple regarding this matter but did not receive a substantial response. Goldman Sachs responded, "We place great importance on fulfilling our obligation to protect customers' deposits."

Apple, which emerged as an icon of financial innovation when starting its savings account business, has suffered a blow to its reputation due to this transfer delay incident. It is known that Apple started the savings account business to increase investors' experience with its software and attract them into the Apple ecosystem.

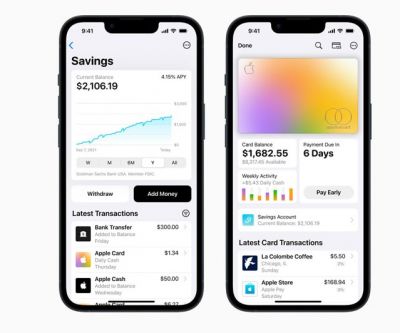

The Apple Savings Account is a product that can be opened through the Wallet application on the iPhone and gained sensational popularity by offering an annual interest rate of 4.15%. The 4.15% interest rate is more than ten times higher than the national average for U.S. savings deposits (0.35%). Due to the high interest rate, about 240,000 accounts were opened in the first week alone.

To open this account, one must possess an Apple Card and can only open it through Goldman Sachs. Currently, it is only available in North America, including the United States. There are no fees for any deposits or withdrawals, and there is no minimum deposit required to maintain the account. However, the maximum deposit amount is up to $250,000, guaranteed by U.S. financial authorities.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.