Nakao Limits Wage Increase Rate to Single Digits... Performance Bonuses Cut

Game Companies Also Freeze Team Leaders' Salaries and Slim Down Organizations

Profitability Worsens Due to Economic Downturn... Outlook for This Year Remains Gloomy

[Asia Economy Reporter Yuri Choi] The IT industry is tightening its belt. Companies are busy cutting costs by lowering this year's salary increase rates and reducing performance bonuses. With profitability having worsened last year due to the economic downturn, the outlook for this year is bleak, causing companies to brace themselves.

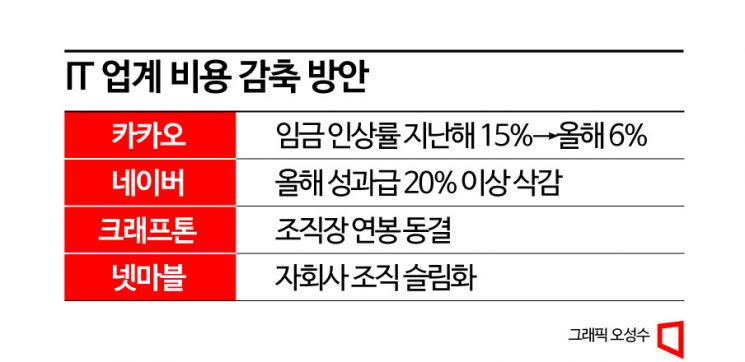

On the 30th, two Kakao affiliates, Kakao Bank and K&Works, which operates Kakao's advertising and shopping services, concluded their wage negotiations for this year. While average wages were raised by about 10% last year, this year's increase rate is in the single digits. This reflects Kakao's decision to lower its wage increase rate from 15% last year to 6% this year. Other affiliates are experiencing a similar atmosphere. A Kakao union official explained, "Seven other affiliates are still in wage negotiations, but overall they are affected by the difficult economic conditions."

Naver will begin wage negotiations this week. Although salaries were increased by 10% last year, this year's increase rate is expected to slow down. With profitability declining last year and large-scale mergers and acquisitions (M&A) underway, it is anticipated that the salary budget will be reduced.

This year's performance bonuses have also been cut compared to last year. While there are differences by organization and individual, bonuses have been reduced by more than 20% compared to the previous year. As of 2021, the average annual salary of Naver employees was 130 million KRW. Based on the average salary, if a mid-level performer received about 25 million KRW, which is 20% of their annual salary, as a performance bonus last year, this year it has decreased by 5 million KRW.

The situation is similar in gaming companies. Krafton has decided to freeze the salaries of team leaders starting in March. The allowance for remote work, which was twice a week at the discretion of team leaders, will be reduced to once a week. The intention is to maintain vigilance during the economic downturn and improve organizational efficiency.

Krafton CEO Kim Chang-han said at the company's internal communication program "Krafton Live Talk" on the 19th, "Although this year is a difficult time with the global economy in recession, it is also an opportunity to build an efficient organization," adding, "We will do our utmost to strengthen organizational capabilities and achieve financial performance."

Netmarble has streamlined its subsidiary organizations. Netmarble F&C, a subsidiary and developer of Netmarble, announced on the 16th that it will merge with another developer within the group, Metaverse Games. Metaverse World, an affiliate responsible for new metaverse-related businesses at Netmarble, has reduced its workforce. Some P2E (Play to Earn) developers were transferred to Netmarble F&C, and some game planning staff completed their probation period but were not hired as regular employees.

The industry's move to cut costs stems from challenging management conditions. Naver and Kakao are expected to see operating profits decline by 0.85% and 1.53%, respectively, compared to the previous year. This marks the first annual decline in operating profit in five years since 2017. With advertising and commerce sales, the main sources of revenue, decreasing or slowing in growth, difficult conditions are expected to continue this year. The gaming industry is also generally experiencing poor performance. Although labor costs have increased significantly, no major hit titles were released last year. While many new titles are planned for release this year, there are concerns about whether game consumption, weakened by the COVID-19 endemic and economic slowdown, can be revived.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.