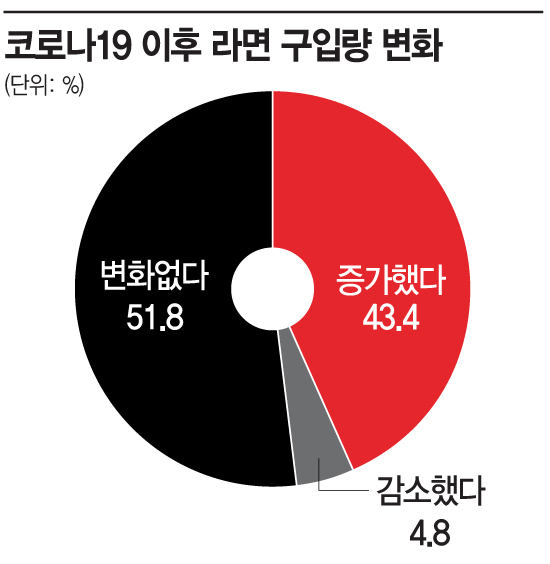

Increase in Ramen Purchases by 43.4% After COVID-19, Decrease by 4.8%

Home Meal Frequency Highest at 38.7% Increase... Convenience and Reduced Dining Out Follow

Positive Product Responses at 80.8%, Generally Satisfied... Eating Frequency 1.7 Times per Week

[Asia Economy Reporter Eunmo Koo] Amid busy daily lives, domestic consumers' affection for ramen, which offers a simple yet reliable taste for a meal, remains strong even after COVID-19. However, recent price increases have been perceived as a burden.

According to the Korea Agro-Fisheries & Food Trade Corporation (aT) on the 27th, domestic consumers' ramen purchases have increased since COVID-19. A consumer survey conducted by aT at the end of June, targeting 500 adult men and women who had purchased ramen products within the past six months, showed that 43.4% responded that their purchase volume had 'increased' compared to before, while only 4.8% said it had 'decreased.'

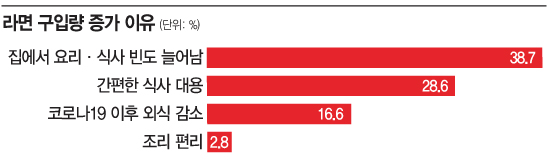

The main reason for the increase in ramen purchases was 'increased frequency of cooking and eating at home,' accounting for 38.7%. This was followed by convenient meal replacement (28.6%), reduced dining out after COVID-19 (16.6%), and ease of cooking (2.8%). It is interpreted that the eating habits of consumers who prepare meals conveniently at home influenced the change in ramen purchase volume.

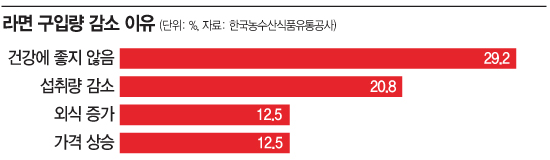

On the other hand, the primary reason for decreased purchases was 'unhealthy' at 29.2%.

The share of product purchase channels was 77.6% offline and 22.4% online. Although purchases through online channels have increased, the tendency to see products in person before buying means offline purchases remain higher. Among offline channels, large supermarkets with a wide variety of items accounted for the highest purchase rate at 36.6%, followed by small supermarkets (15.6%), convenience stores (8.4%), and large grocery stores (5.8%). Online, large supermarket online malls offering bundle sales and price discounts had a high share at 8.0%.

The average ramen consumption frequency was 1.7 times per week or more, mainly consumed at home during weekends and lunch. Consumer satisfaction was rated 3.9 out of 5, with 80.8% of respondents satisfied due to reasons such as good taste (36.4%), variety (18.8%), and convenience (8.9%).

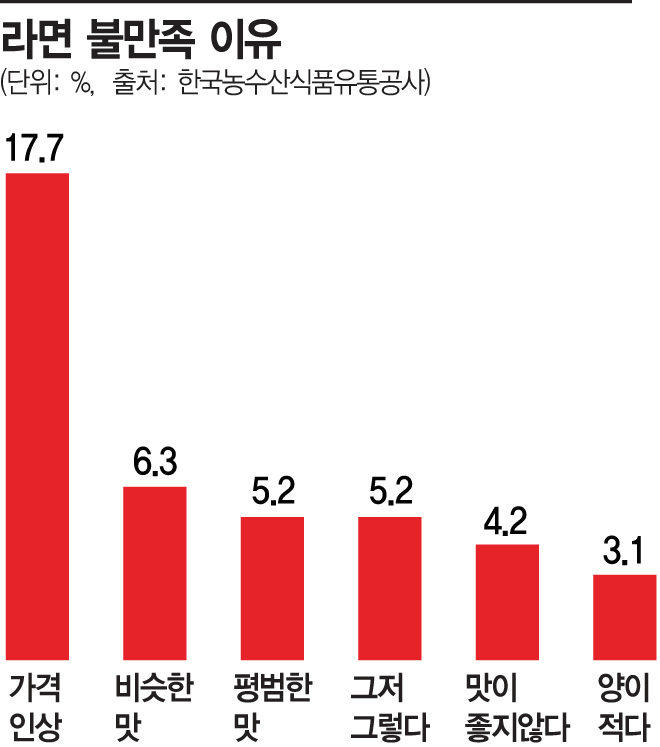

Conversely, respondents who were dissatisfied cited 'excessive price increases' as the biggest reason. Recently, ramen companies have raised prices citing increases in raw material costs such as flour, palm oil, and potato starch. Nongshim raised the ex-factory price of major ramen products, including Shin Ramyun, by an average of 11.3% starting from the 15th. Ottogi will increase the ex-factory price of ramen products, including Jin Ramen, by an average of 11.0% from the 10th of next month. Paldo will also raise ramen prices by an average of 9.8% starting from the 1st of next month.

Professor Eunhee Lee of Inha University's Department of Consumer Studies said, "As the number of single-person households unfamiliar with cooking continues to increase, ramen consumption will also continue to grow." She added, "However, with various alternative products such as meal kits being launched, the key will be how to maintain competitiveness against them." Furthermore, she noted, "With the ramen lineup becoming more diverse than ever, including premium products, and considering that ramen is a product consumed by students and low-income groups, it is desirable to minimize price increases for basic products."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.