Resale Rumors Rekindled

Uncertain Profitability

Compensation for Strike Damages

[Asia Economy Reporter Oh Hyung-gil] Daewoo Shipbuilding & Marine Engineering (DSME) is accelerating the normalization of operations after the strike by subcontractor workers that lasted for over two months has come to an end, but there is still a long way to go before management returns to a normal track. Three key issues?sale, profitability recovery, and compensation for strike damages?have surfaced as priorities.

According to industry sources on the 3rd, KDB Industrial Bank plans to soon establish a mid- to long-term management plan for DSME. The results of the external management consulting for DSME are also expected to be disclosed as early as next month. However, the bank maintains a firm stance that additional liquidity support, which DSME urgently needs, is not possible at this time.

As a result, the sale rumors that fell through earlier this year have reignited. At the center of this is the idea of a split sale.

Kang Seok-hoon, chairman of the Industrial Bank, sparked the discussion by stating, "Various options, including split sales, are being considered." DSME operates a defense business that builds warships and submarines, making overseas sales difficult due to concerns over technology leakage. There is an expectation that separating the commercial and special ship sectors would make it easier to find buyers.

However, there are opinions that dividing the shipyard into business units is difficult and inefficient. DSME employees also strongly oppose the split sale. The Metal Workers' Union DSME branch protested on the 28th of last month against the split sale rumors, stating, "The sale of DSME, which will determine the future of the shipbuilding industry, cannot proceed without the understanding and consent of its members."

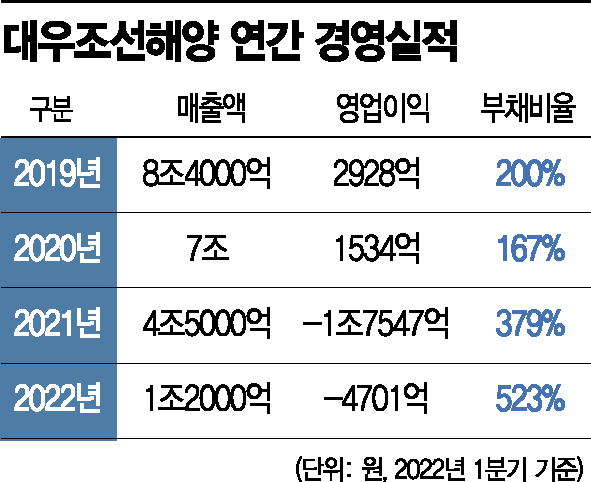

Uncertain profitability is also hindering normalization. As of the end of March, DSME's debt ratio exceeded 500%, recording both operating losses and net losses. With total capital of 1.6359 trillion KRW and total liabilities of 8.9424 trillion KRW, the debt ratio stands at 546.6%.

Although the shipbuilding market is improving due to consecutive orders, rising new ship prices, and stabilization of steel plate prices, a return to profitability is expected only next year. Uncertainties remain, such as the cancellation of icebreaking LNG ship contracts due to sanctions against Russia.

Whether economic damages caused by the strike can be recovered is also a key issue. Police investigations are ongoing into the members of the Geoje-Tongyeong-Goseong Shipbuilding Subcontractors' Union who led the strike, and civil lawsuits for damages are expected to proceed soon.

The company estimates that the strike by the subcontractors' union delayed the launching of Dock 1 by about five weeks, resulting in losses of approximately 800 billion KRW. However, the specific amount of damages is expected to decrease during the litigation process, though company losses are inevitable.

A DSME official said, "There is no change in our position to respond according to law and principles," adding, "Currently, we are focusing all our capabilities on making up for the delayed production schedule."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.