Last Year Silimarin Followed by Celltrion Pharm's 'Godeks' Facing Delisting Risk

Plan to Submit Appeal to HIRA

Once a Best-Selling Product with No Domestic Competitors

Companies Preparing Generics Also Impacted

Opportunity Expected for Other Liver Medicines Like 'Urusa'

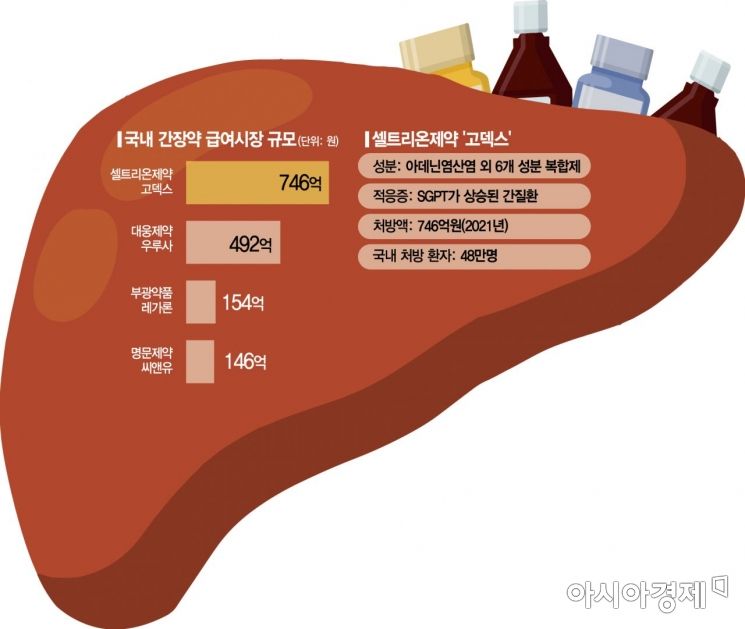

[Asia Economy Reporter Lee Chun-hee] Celltreon Pharm’s cash cow product “GODEX,” with annual sales reaching 70 billion KRW, is facing the risk of being excluded from insurance coverage. Following the exclusion of Silimarin (milk thistle extract) and other liver disease medications from reimbursed drugs, the liver medicine market is expected to undergo a major upheaval.

Celltrion Pharm Cornered

According to industry sources on the 13th, the Health Insurance Review and Assessment Service (HIRA) decided on the 7th at the Drug Reimbursement Evaluation Committee meeting that the combination drug containing adenine hydrochloride and six other ingredients is “not appropriate for reimbursement.” Currently, aside from GODEX, no other drugs containing these ingredients are distributed domestically. This follows last November’s conclusion that the clinical usefulness of Silimarin, also used for liver diseases, was insufficient, leading to its exclusion from reimbursement, continuing the harsh saga of liver medicines.

HIRA explained that the reasons for GODEX’s exclusion from reimbursement were unclear clinical usefulness and cost-effectiveness. In response, Celltrion Pharm stated, “We have proven efficacy for liver diseases through various clinical trials” and “We will prepare various materials and submit an objection letter.”

Another reason cited is the status of overseas expansion. If a drug is listed for reimbursement in fewer than two of the eight advanced countries (United States, United Kingdom, France, Italy, Japan, Germany, Switzerland, Canada), it becomes subject to reassessment of reimbursement appropriateness. GODEX has yet to enter overseas markets. However, the industry points out that passing this criterion is as difficult as a camel passing through the eye of a needle. Since it is extremely rare for domestically developed new drugs, rather than imported medicines, to succeed in reimbursement listing in the eight advanced countries, the industry has been requesting a relaxation of the criteria to a more realistic level, but no improvements have been made yet.

GODEX, approved in 2000, has been Celltrion Pharm’s flagship liver medicine for 22 years. Last year, Celltrion Pharm recorded sales of 69 billion KRW from GODEX alone. It was a steady revenue generator with sales of 65 billion KRW in 2019 and 65.7 billion KRW in 2020.

The absence of competitors despite significant sales volume also enabled GODEX’s dominance. Although the related patent expired in November 2019, no generics have emerged. While one of the manufacturing method patents for the combination ingredients is still valid, Celltrion Pharm distinguishes this as a patent secured for developing follow-up drugs rather than extending GODEX’s patent, indicating it is not an insurmountable patent. In April, the Ministry of Food and Drug Safety reported that among 753 drugs with expired patents, GODEX recorded the highest production performance of 73.7 billion KRW among those without follow-up generics launched.

Turbulence in the Liver Medicine Market Landscape

This is expected to be a major blow to other companies preparing to develop generics. Despite many development challenges such as biological equivalence beyond patents, companies preparing generics for this high-revenue drug have reportedly slowed development since it became subject to reimbursement reassessment.

On the other hand, GODEX’s exclusion from reimbursement is expected to be an opportunity for other liver medicines. In the domestic liver medicine market, GODEX has held an unchallenged first place since 2017, followed by Daewoong Pharmaceutical’s “Urusa,” Bukwang Pharmaceutical’s “Regaron,” and Myungmoon Pharmaceutical’s “C&U.” However, Regaron, which also contains Silimarin as the main ingredient, was included in last year’s reimbursement exclusion list and is currently involved in related litigation, while C&U is subject to clinical reassessment and must re-prove efficacy through clinical trials. Meanwhile, Urusa, initially expected to be included in the reimbursement reassessment list, has been excluded until next year, allowing it to gain a windfall benefit while competitors hesitate.

However, the Drug Reimbursement Evaluation Committee’s review is not the final decision. Since this is only the first review, procedures such as the pharmaceutical company’s objection, the Drug Post-Review Subcommittee, and the committee’s re-evaluation remain. A Celltrion Pharm official said, “We plan to prepare related documents again and proceed with the objection” and “We will sincerely cooperate with relevant departments during the objection period to convey the company’s position.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.