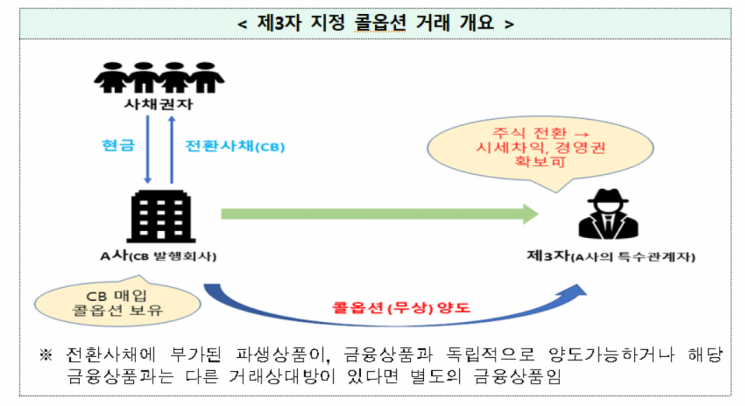

[Asia Economy Reporter Lee Jung-yoon] The Financial Services Commission announced on the 3rd that from this year, companies issuing third-party designated call option convertible bonds (CBs) must account for all held call options as 'separate derivative assets.' Additionally, the issuance conditions must be disclosed in the notes. Third-party designated call option convertible bonds grant the right to a third party to purchase convertible bonds at a predetermined price at the time of issuance.

The Korea Accounting Standards Board's joint inquiry meeting judged that when a third-party designated call option is granted to the issuer of convertible bonds, the call option can be transferred to parties other than the issuer in the future, and therefore must be accounted for as a separate derivative asset distinct from the convertible bonds. Furthermore, if the call option is recognized as a separate derivative asset, its fair value must be evaluated at each fiscal year-end and reflected in the financial statements.

As a result of reviewing the accounting treatment of domestic companies through currently disclosed business reports, it was found that most companies did not recognize third-party designated call options as separate derivative assets.

Accordingly, the Financial Services Commission has stipulated through supervisory guidelines that even if derivatives are attached to certain financial products, derivatives that can be transferred independently from the financial product or have different counterparties from the financial product must be accounted for as separate financial products. The scope of application includes convertible bonds issued before the announcement of the supervisory guidelines, except in cases where the relevant call options have been removed. The guidelines apply from the financial statements issued and disclosed after the announcement of the supervisory guidelines.

If it is practically difficult to identify past error amounts, the error amount should be identified as of the beginning of the current period and the cumulative effect reflected in the beginning capital. However, if it is difficult to identify the cumulative effect as of the beginning of the current period, the cumulative effect may be reflected in the current period's financial statement profit or loss.

Moreover, when call options are accounted for as separate derivative assets, the conditions of the call options and their impact on the current and previous financial statements must be disclosed in the notes.

The Financial Services Commission stated that although retrospective restatement is the principle since failure to separately account for these is a significant accounting error, considering practical customs, unnecessary confusion caused by revaluation at the past issuance date, and the impact on financial statements, prospective application is permitted for situations arising after the adoption of the new accounting policy.

Also, depending on individual circumstances, if there are reasonable grounds, accounting treatment may differ from the guidelines, but the reasons must be detailed explicitly.

The Financial Services Commission expects that with this guideline, the presence of third-party designated call options will be separately indicated in financial statements, enabling information users such as minority shareholders to more easily understand the issuance conditions of convertible bonds.

A Financial Services Commission official said, "In the future, for matters that are difficult to interpret or apply in accounting standards, we plan to prepare and announce guidelines within the reasonable interpretation scope of accounting standards," adding, "We will operate an accounting standards application support team within the Korea Accounting Standards Board and proactively identify industry-specific issues to resolve accounting uncertainties."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.