[Asia Economy Reporter Song Seung-seop] Financial public institutions are embarking on long-term debt management. The core is to reduce the default rate and improve asset soundness through monitoring. Although there are still voices calling for an increase in the scale of financial support, it seems that there is a consensus on the need to restrain the rapidly increasing debt of financial public institutions due to COVID-19 support policies and others.

According to the public institution management information disclosure system "Alio" on the 29th, the Korea Inclusive Finance Agency set resource expansion and asset soundness management as the basic direction in its mid- to long-term financial management plan for the third quarter of this year. It decided to enhance financial stability to expand sustainable policy financial supply to low-income and vulnerable groups. It set goals to actively manage the guarantee business operation multiple and default rate and to stably operate financial assets for the utilization of business resources.

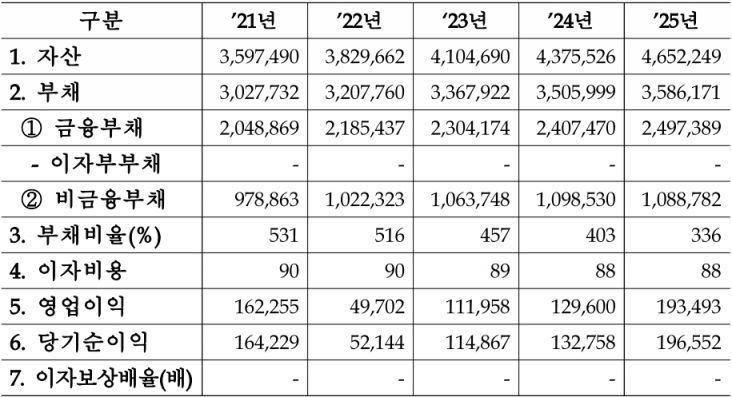

The debt ratio of the Korea Inclusive Finance Agency was 682% as of 2020, which is high compared to the overall public institution debt ratio of 172.2%. It is expected to decrease to 531% this year and 336% by 2025.

The agency plans to supply within the statutory guarantee multiple (15 times) to manage soundness while flexibly responding to government policies for financial supply. It also plans to actively manage the default rate of guarantee assets. Through risk management at each stage from screening financial products to post-management, it minimizes the possibility of asset default. To secure resources, it will increase the contribution from financial companies from 228.4 billion KRW this year to 312 billion KRW by 2025.

The Korea Credit Guarantee Fund will also manage financial stability by controlling default rates, debt ratios, and operation multiples. In particular, it sets the guarantee account, which accounts for 92.0% of institutional debt, as the main financial management target and checks the target default rate. Despite factors such as COVID-19 and economic uncertainty, the fund limits the net increase rate of general guarantee defaults to within 3.3% this year. Considering the default trend immediately after the economic crisis, the default rate may rise until next year but will be managed downward from 2023.

In addition, for the Small and Medium Enterprise Sales Credit Insurance business, it enhances monitoring and improves the screening system to reduce the insurance accident rate, thereby improving fiscal soundness. The Industrial Base Credit Guarantee Fund implements active post-management and provision liability management. The Cultural Industry Completion Guarantee plans to reduce debt by newly introducing a content evaluation system and strengthening screening.

The Korea Deposit Insurance Corporation also proposed a self-sustaining fund management plan through maximizing bankruptcy dividends of special accounts, as it did last year. It diversifies the sale of assets held by the bankruptcy estate and strengthens the recovery of bankruptcy dividends. Through this, it plans to reduce 800 billion KRW in debt over the next five years. It also minimizes interest expenses and strives to generate revenue such as deposit insurance premiums to reduce 5 trillion KRW in debt during the same period.

The deposit insurance fund's debt plan for the end of 2024 was also revised to reduce an additional 1 trillion KRW compared to the previous year. This is due to the expansion of debt reduction performance and an increase in insurance premium income resulting from an increase in insured deposits.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.