Rising Jeonse Prices Accelerate Loans

Despite July Off-Season, Increased by 2 Trillion Won Compared to Previous Month

[Asia Economy Reporter Kiho Sung] It has been revealed that jeonse loans increased by as much as 13 trillion won in the first half of this year. In particular, despite July being an off-season due to the rainy season and summer vacations, jeonse loans surged by about 2 trillion won compared to the previous month, accelerating the rapid increase in jeonse loans. Experts point out that the loan balance is further increasing as real estate price hikes have driven up jeonse prices. Additionally, with the full-scale moving season in the second half of the year approaching, jeonse prices may soar even higher, leading to predictions that this year's jeonse loan balance could exceed 130 trillion won.

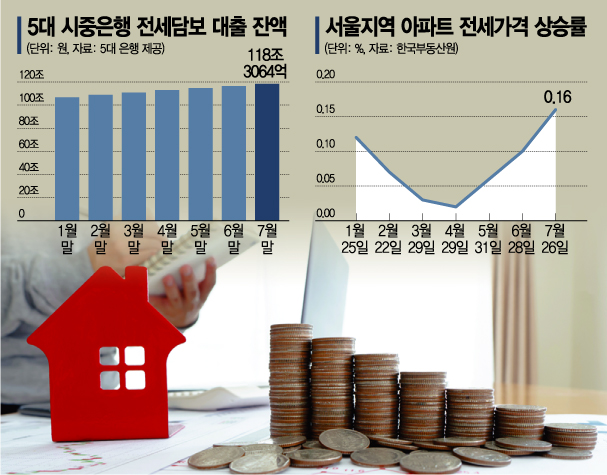

According to the financial sector on the 7th, the jeonse loan balance at the end of July for the five major banks?KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup Bank?stood at 118.3064 trillion won, a net increase of 1.9727 trillion won compared to the previous month. If this trend continues, it is expected to surpass 120 trillion won by the end of August.

The issue is that the loan amount surged even during the off-season, which is not the usual moving season. The jeonse loan balance exceeded 2 trillion won during the moving season from February to April but decreased to around 1.5 trillion won by the end of June. However, despite July being an off-season due to the rainy season and summer vacations, and the government's implementation of the Debt Service Ratio (DSR), the loan balance turned to an increase.

The jeonse loan balance is also showing a sharp upward trend compared to last year. The jeonse loan balance, which was 106.7176 trillion won in January this year, increased by 13.2076 trillion won in seven months. This figure is over 1 trillion won higher than the 12.1399 trillion won increase during the same period last year.

The main reason behind this is that as housing prices surged, jeonse prices rose simultaneously. According to the Korea Real Estate Board, the jeonse price change rate for apartments in Seoul in the fourth week of July recorded a 0.16% increase. This surpassed the highest rate this year of 0.12% in January and was the largest increase since the first week of August last year (0.17%), right after the new lease law was enacted. Apartment prices in the metropolitan area rose by 0.36% in the fourth week of July, marking the highest increase for two consecutive weeks since statistics began in May 2012.

Lee Eun-hyung, a senior researcher at the Korea Construction Policy Institute, analyzed, "Since July is usually an off-season for moving, it is difficult to say that the number of jeonse loan cases itself increased. However, overall real estate prices are rising, and accordingly, jeonse prices themselves are increasing, which has led to the rise in loan balances."

The market expects more jeonse loans to be made with the arrival of the autumn moving season. Accordingly, there are predictions that this year's jeonse loan balance could exceed 130 trillion won. There is concern that if the jeonse loan balance rises sharply and housing prices fall in the future, jeonse loans could lead to defaults.

The senior researcher added, "Moving usually takes place mostly in spring and autumn, excluding cold or hot seasons. Considering the increase rate during this spring's moving season and forecasting demand for the autumn moving season, the demand for jeonse loan funds this year could approach 130 trillion won."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.