Branch Visit Reservation Services Expanding Using Bank Apps or Big Tech

[Asia Economy Reporter Park Sun-mi] Jung Un-hoo (41 years old, pseudonym), who works in Yeouido, recently visited his main bank, Shinhan Bank, for a loan consultation but gave up and left. The waiting time was getting longer, and he was worried about being late for a pre-scheduled meeting. When he confided in a nearby employee, he learned that some branches offer a service to make reservations for visits during less busy times. The next day, Jung made a visit reservation through his mobile phone for Shinhan Bank’s Seo-Yeouido branch and was able to conduct his transaction immediately.

With social distancing measures and the enforcement of the Financial Consumer Protection Act (FCPA), banks are working to reduce customer density inside branches, leading to the expansion of branch visit reservation services using bank applications (apps) or portal sites.

According to the financial sector on the 11th, IBK Industrial Bank of Korea has begun selecting a contractor for the “advancement of the queue guidance system for branch visit reservation services.” Currently, a bidding announcement is underway to select a contractor by the end of this month, with the goal of implementing the service within the year.

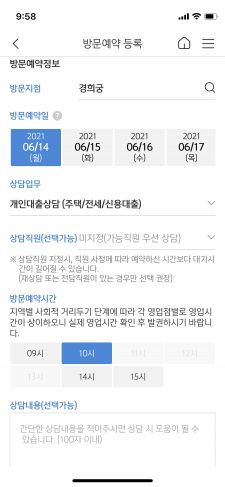

This service allows customers using the bank app i-ONE Bank or big tech platforms (large information and communication companies) to make branch visit reservations via mobile in advance for tasks such as personal loans and asset management. When a customer makes a branch visit reservation via mobile, the bank aggregates the reservation status and prepares for the consultation in advance. When the customer visits the branch on the reserved date, the bank prioritizes the queue number to call the customer and proceed with the consultation.

The consultation details are registered in the Customer Relationship Management (CRM) system. The inconvenience of visiting the branch, taking a number ticket on-site, and waiting in line disappears, and by making a reservation, customers can prepare the necessary documents in advance as guided during the reservation, improving work efficiency.

IBK Industrial Bank of Korea stated regarding the expected effects of the branch visit reservation service, “By linking with Personal Financial Management (PFM) services that utilize personal financial information scattered across the entire financial sector including banks, cards, and insurance, it is possible to create synergy by connecting customers who use PFM services and require professional consultations to become exclusive bank customers through the visit reservation service.”

Expansion of Reservation Services in the Banking Sector... Reducing Waiting Time and Increasing Work Efficiency

Currently, some commercial and regional banks provide branch visit reservation services through their bank apps and are expanding these services to portal sites. Banks that have not yet introduced such services are also promoting the adoption of visit reservation services through bank apps in response to digital transformation and the shift toward mobile-centered financial environments.

KB Kookmin Bank operates a service called the “Smart Reservation Consultation System.” Customers can directly set and reserve specific times at branches, and applications can also be made through internet banking or the Star Banking app. Separately, Kookmin Bank introduced a “Pre-Completion Service” in December last year, allowing customers to fill out necessary documents on a tablet PC during waiting times for banking tasks.

Shinhan Bank offers visit reservation services through its bank app “SOL,” call centers, and branch counters. This service, which began as a pilot at 41 branches in July 2019, is now available at 238 branches and is planned to expand to all branches within the year. Customers can specify the date, time, and type of service at the branch they plan to visit and make a reservation within 10 business days. Reservation application statuses are notified to the responsible staff in real time via messages.

Woori Bank is the first in the domestic financial sector to display the number of waiting customers at branches on Naver Maps. After checking customer numbers at about 400 major branches in Seoul and the metropolitan area, mobile number ticket issuance is possible before visiting the branch. Currently, the bank is also working on building a branch visit consultation reservation service and preparing a service that provides estimated waiting times by time slot at each branch through big data analysis.

Hana Bank operates a service within its mobile app Hana One Q’s Digital Branch tab that allows customers to select desired services and issue waiting tickets before visiting branches. NH Nonghyup Bank allows branch visit reservations through its bank app and is separately preparing a financial product reservation consultation service using an artificial intelligence (AI) banker.

A representative from a commercial bank explained, “Considering branch conditions, adjusting the number of customers who can make reservations by busy days, busy hours, and time slots can prevent inconvenience to non-reservation customers and also reduce actual customer waiting times.” Another bank employee added, “With the enforcement of the Financial Consumer Protection Act, the processing time per customer has increased, causing longer waiting times than before. The banking sector is making efforts not only to reduce waiting times through visit reservations via apps but also by developing and deploying AI bankers capable of handling tasks at a level similar to actual staff.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.