Korea Real Estate Board February Nationwide Housing Price Trends

Capital Region Housing Price Increase Rate Highest in 13 Years

Seoul and Incheon Home Price Growth Also Expands... Bull Market

Seoul Average Housing Price Surpasses 800 Million Won for the First Time

However, Transaction Volume Plummets... Possible Future Adjustment

[Asia Economy Reporters Moon Jiwon, Lim Onyu] Despite the government's 2·4 housing supply measures, last month saw the highest increase in housing prices in the Seoul metropolitan area in 12 years and 8 months. The average sale price of housing in Seoul surpassed the 800 million KRW mark for the first time.

Although the government has recently issued successive signals to expand supply, the effect of the measures has been offset by increased buying demand driven by expectations surrounding the Metropolitan Area Express Train (GTX).

According to the February nationwide housing price trend survey released by the Korea Real Estate Board on the 2nd, housing prices in the Seoul metropolitan area, including Seoul, Incheon, and Gyeonggi Province, rose by 1.17% compared to the previous month. This is the largest monthly increase since June 2008, when it recorded 1.80%, marking the biggest rise in 12 years and 8 months.

GTX Swallows Up the Effect of the 2·4 Measures

The housing price increase rate in the metropolitan area, which was 0.8% in January, surged to over 1% in February. Gyeonggi Province led the price increase. While Seoul rose from 0.40% to 0.51% and Incheon from 0.72% to 1.16%, Gyeonggi Province's increase was steeper, rising from 1.11% to 1.63%.

This survey covered the period from January 12 to February 15, reflecting the effects of the government's 2·4 measures, which include plans to expand supply by 830,000 households nationwide.

Nonetheless, the significant rise in housing prices indicates strong upward pressure driven by expectations of GTX and the easing of reconstruction regulations.

In Seoul, areas with increased reconstruction expectations linked to the Seoul mayoral by-election, such as Nowon-gu (0.86%) and Seocho-gu (0.60%), and areas near Changdong Station in Dobong-gu (0.81%), which benefits from the GTX-C development, saw significant price increases.

In Gyeonggi Province, housing prices surged sharply in Uiwang-si (3.92%) and Uijeongbu-si (2.76%), where there is anticipation of GTX-C line stops, as well as in Namyangju-si (3.45%), which benefits from the GTX-B line.

When limited to apartments, the price increase is even greater. Apartment prices in the metropolitan area rose by 1.71% last month, the largest increase since April 2008 (2.14%), and Seoul recorded 0.67%, the highest since July last year (1.12%) when the new lease law was implemented. Conversely, row houses, which have seen growing fears of 'cash settlement' since the announcement of the 2·4 measures, showed a slowdown in price increases in both Seoul and the metropolitan area.

Due to this price rise trend, the average housing price in Seoul exceeded 800 million KRW for the first time. According to KB Kookmin Bank's Liv Real Estate data released on the same day, the average sale price of housing in Seoul in February was 800.975 million KRW, up 12.34 million KRW from the previous month (799.41 million KRW). This is the highest price since KB Kookmin Bank began publishing this statistic in December 2008.

Seoul Transactions Show Cautious Sentiment... Possible Future Price Adjustments

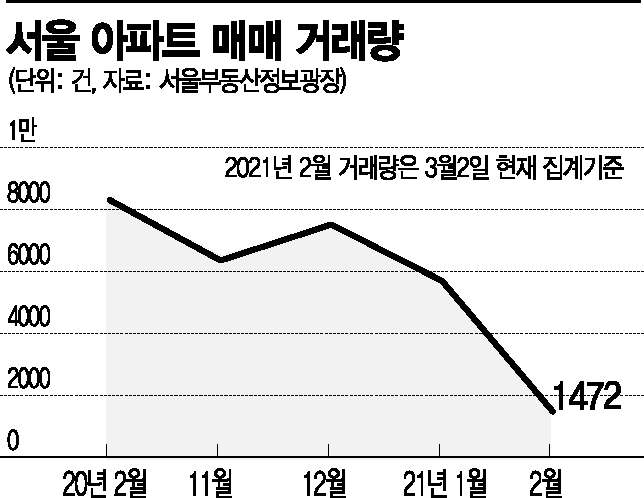

However, there is also analysis that it is difficult to easily gauge the future real estate market situation as transaction volumes have sharply declined since the 2·4 measures. According to the Seoul Real Estate Information Plaza, apartment sales transactions in February were 1,472, a 74% drop compared to 5,690 in the previous month.

Since the housing transaction reporting period is within 30 days after the contract, February statistics will be finalized at the end of March, but the industry evaluates that the decline is clearly significant enough to be called a 'transaction cliff.'

Typically, when housing transaction volumes increase significantly, prices rise, and conversely, prices adjust when volumes decrease. For this reason, some cautiously speculate that Seoul housing prices may have entered a correction phase.

Minister of Land, Infrastructure and Transport Byun Changheum recently stated at a policy meeting, "It is somewhat early to evaluate the effect of the measures, but various indicators show that the previously overheated buying demand is generally shifting to a cautious stance."

Many also believe that the temporary rise in cautious sentiment and the resulting decrease in transaction volume after the measures could reverse in the spring due to short-term supply and shortage of jeonse (long-term lease) properties.

A representative from real estate agency A in Gangbuk-gu, Seoul, said, "Buyers and sellers are playing a waiting game over prices, causing transactions to halve," but added, "Since jeonse listings remain scarce, jeonse tenants who couldn't find homes during the spring moving season may turn to buying, which could increase transaction volumes again."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.