No Need to Submit Documents Separately for Financial Services

Available for Credit Loan Applications and Credit Card Issuance

The Korea Credit Information Services explained that when using the public MyData service, some financial tasks can be performed without going through the administrative document submission process.

The Korea Credit Information Services explained that when using the public MyData service, some financial tasks can be performed without going through the administrative document submission process. [Photo by Korea Credit Information Services]

[Asia Economy Reporter Song Seung-seop] The Korea Credit Information Services announced on the 24th that it will pilot the Public MyData project in the financial sector, led by the Ministry of the Interior and Safety. From today, some financial institutions will be able to use the MyData service.

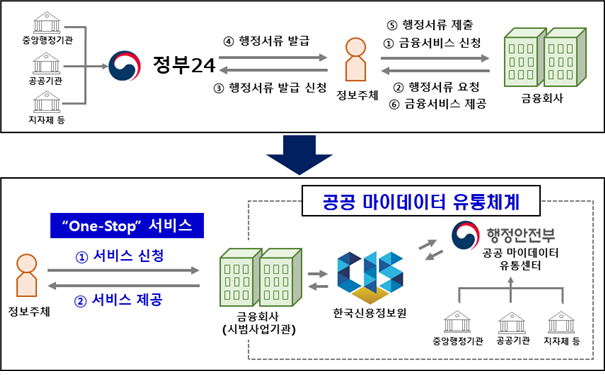

The Public MyData project refers to a service that allows individuals to exchange or transmit their scattered personal information held by administrative and public institutions as data. It is one of the key tasks of digital government innovation, enabling individuals to freely manage their data with consent.

Until now, to use financial services requiring administrative documents, one had to visit a community service center or obtain documents directly from the government-operated website ‘Government24.’ Financial companies had to wait until customers submitted the documents, consuming time and costs.

The Credit Information Services explained that using the Public MyData service significantly simplifies the cumbersome administrative document submission process. This is because the Credit Information Services delivers personal information from various public institutions to financial companies in real time.

Another advantage is that data can be exchanged more securely than the ‘screen scraping’ method used by some financial companies. Screen scraping is a technology that extracts data from website screens through the authentication of the information subject.

Currently, the Public MyData service is available at nine financial companies, including KB Kookmin, NH Nonghyup, Woori, Hana Bank, and KB Kookmin, Samsung, Shinhan, and Hyundai Card, which have been conducting pilot services together with the Credit Information Services. There is no need to separately submit administrative documents required for some tasks such as applying for credit loans and issuing credit cards.

Shin Hyun-jun, president of the Credit Information Services, emphasized, “Not only will the cumbersome procedures be simplified, but digital underprivileged individuals will also be able to enjoy one-stop services without visiting community service centers separately. Financial companies will be able to greatly reduce time and costs while also planning various innovative services utilizing public data.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.