"Similar to Early US Great Depression Policies"

"Must Prepare by Expanding Currency Swaps"

[Asia Economy Reporter Dongwoo Lee] There is a claim that the recovery period of the Korean economy due to the novel coronavirus infection (COVID-19) crisis may take longer than during the global financial crisis. It is pointed out that the pattern resembles anti-market policies that worsened the U.S. Great Depression in the past.

The Korea Economic Research Institute announced on the 12th through its report titled "Differences Between Major Economic Crises and the Current Crisis and Future Prospects" that a V-shaped rebound will be difficult even after the end of the COVID-19 crisis.

The report argued that during the early U.S. Great Depression in 1933, the National Industrial Recovery Act was enacted, implementing strong anti-market policies such as the introduction of minimum wage, maximum working hours (40 hours per week), and production restrictions, which worsened the economic crisis and delayed the recovery time from the crisis.

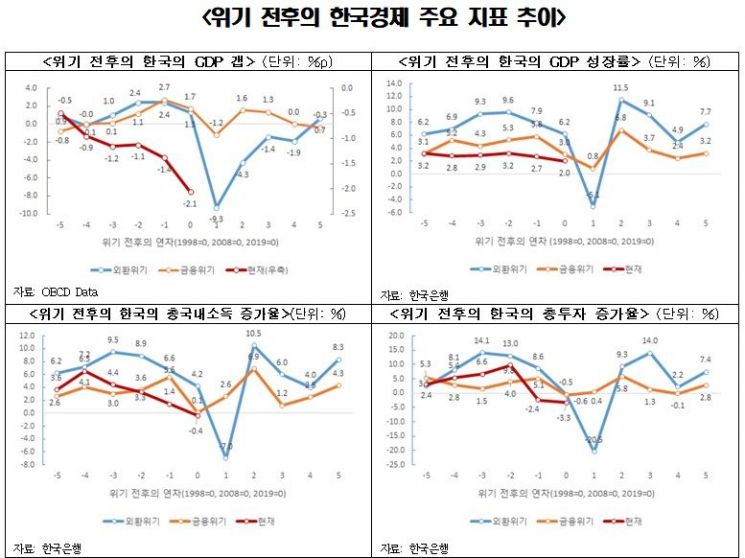

The report pointed out that the actual Gross Domestic Product (GDP) gap has been continuously declining and had already fallen to minus 2.1 percentage points last year, which is lower than the GDP gap of -1.2 percentage points in 2009 reflecting the shock of the global financial crisis. It also emphasized that if the current crisis is reflected in the growth rate, the 2020 GDP gap will fall much further.

Cho Kyung-yeop, head of the Economic Research Office, said, "During the 2008 global financial crisis, the fundamentals of the Korean economy were not bad, so a rapid recovery from the crisis was possible, but the situation is different now. Due to income-led growth represented by minimum wage increases, reduced working hours, and expansion of cash welfare, the decline in the Korean economy's growth rate was gradually increasing."

He added, "Even without the COVID-19 crisis, growth of around 1% was already forecast for this year, so without a revolutionary policy shift, it is expected to take considerable time to escape from a severe economic recession even if the current infection crisis ends."

The report also anticipated significant volatility in financial markets due to COVID-19 in the future. It forecast that it would take considerable time to restore the stability before the crisis. In the stock market, short-term sharp rises in stock prices may occur depending on major countries' economic stimulus measures, but without improvement in the real economy, it will be difficult to escape the downward trend.

In particular, considering that it took about three years for the KOSPI to recover to pre-crisis levels during the global financial crisis, the report argued that there is a high possibility of a long-term slump in the stock market in this crisis as well.

Meanwhile, it evaluated that the possibility of a foreign exchange crisis is low at the current level of foreign exchange reserves but analyzed that the possibility could increase if the economic crisis prolongs.

Cho said, "If the current account deficit accumulates due to prolonged export sluggishness and economic fundamentals continue to weaken, leading to expanded capital outflows, psychological anxiety among foreign investors may intensify, causing a shortage of foreign exchange reserves," and argued, "It is necessary to expand currency swaps with the U.S. as well as establish currency swap agreements with countries that have permanent and unlimited currency swaps with the U.S. (Japan, the U.K., Switzerland, etc.)."

Analysis of the impact of COVID-19 spread on world trade showed that assuming a shock level similar to the past global financial crisis, the world trade growth rate could decrease by about 6 percentage points. The report also claimed that countries are likely to strengthen protectionist trade measures.

In particular, considering past crisis cases, it was analyzed that protectionist trade measures are more likely to be strengthened by raising non-tariff barriers rather than tariff rates.

The report argued that to endure the current crisis and achieve a rapid recovery after the end of COVID-19, a revolutionary shift in policy direction is necessary. It pointed out that previous policy experiments such as minimum wage increases, corporate tax hikes, and reduced working hours did not help improve the productivity and competitiveness of the Korean economy, and emphasized that overcoming the current crisis and securing momentum to lead the global market after the end of COVID-19 requires a policy shift.

Cho said, "Policies that collect taxes from productive sectors and transfer resources to unproductive sectors increase economic inefficiency and inevitably slow growth," urging for efficiency-centered fiscal management.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.